The Shocking Sell-Off: Is Nvidia's Collapse a Sign of the AI Bubble Bursting?

2024-09-16

Introduction

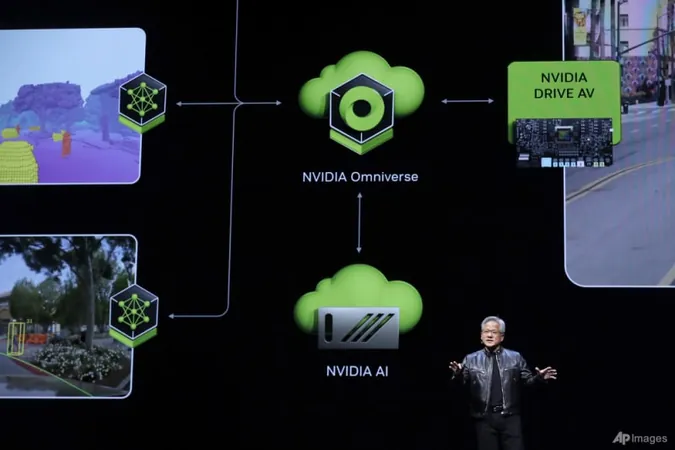

In a recent discussion on the 'Money Talks' podcast, hosts Andrea Heng and Garett Lim delved into the seismic sell-off experienced in the U.S. stock market, focusing particularly on Nvidia—the tech sector's shining star and a cornerstone of the AI industry.

Nvidia's Record Loss

Andrea opened the conversation with a stark observation: "Nvidia has long been hailed as the irreplaceable titan in technology, often referred to as the crown jewel of AI. Yet, during the recent market downturn, it suffered a staggering $279 billion loss in value—a record-breaking one-day wipeout for any company in U.S. history." This leads to the pressing question: Has the long-anticipated AI bubble finally burst?

Market Context and Analysis

Garett offered a more nuanced perspective. "While Nvidia serves as a convenient barometer for AI, it is essential to remember that it is not the sole player in the ever-expanding AI landscape. The significant sell-off can largely be attributed to heavy investments, both institutional and retail, concentrated in Nvidia stock. Many investors have leveraged their positions, borrowing capital to increase their stakes, which can lead to a flurry of margin calls during such a sudden market shock."

Historical Performance

He continued, emphasizing the need for context: "Let’s not forget that Nvidia had an impressive run over the past couple of years. A pullback of 10%, 15%, or even 20% in stock price doesn’t necessarily signal the end of the AI rally; rather, it reflects a natural correction within a historically strong market.”

Looking Ahead

As we navigate this turbulent landscape, experts urge investors to maintain perspective amidst the chaos. Nvidia may face challenges, but the broader implications for the AI sector remain to be seen. What does this mean moving forward for other AI companies, and could this be an opportunity for new entrants into the market?

Conclusion

In conclusion, while the sell-off raises legitimate concerns, it might also pave the way for a more balanced and sustainable growth trajectory for AI technologies. Stay tuned as we continue to explore the future of AI and its influence on financial markets.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)