Dow Plummets 1,600 Points: Is Trump's Latest Tariff Move Sending Shockwaves Through Global Markets?

2025-04-03

Author: Michael

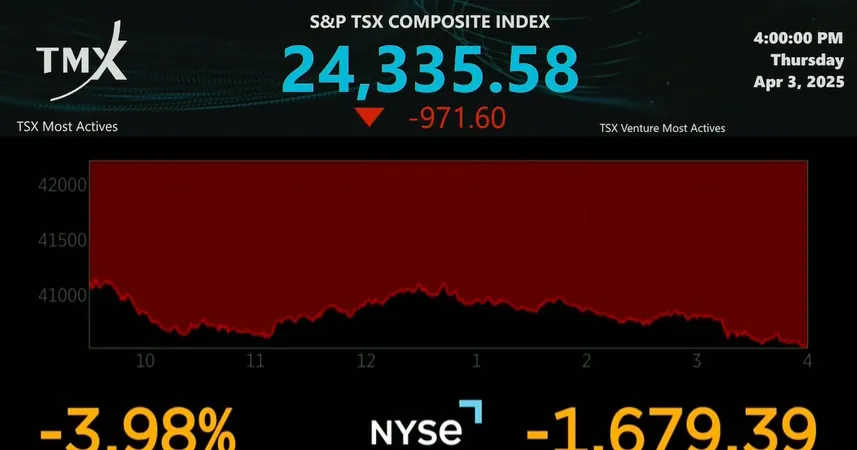

In an unprecedented turn of events, Wall Street experienced a catastrophic plunge reminiscent of the turmoil following the COVID-19 outbreak, as fears over U.S. President Donald Trump’s new tariffs triggered a worldwide sell-off. The Dow Jones Industrial Average crashed by 1,679 points, equivalent to a staggering 4% drop, while the S&P 500 fell 4.8%, marking its worst day since the pandemic-era market collapse in 2020. The Nasdaq composite fared even worse, plummeting by 6%.

As investors scrambled to make sense of the situation, the global financial landscape crumbled under the weight of decision-making laden with uncertainty. Everything from crude oil prices to major tech stocks took a hit, and even gold, typically viewed as a safe haven for investors, saw declines as fears of a mounting economic crisis overshadowed its value.

Tariffs and Economic Impact

The newly announced tariffs consist of a minimum 10% tax on imports, with even steeper penalties on goods from specific countries, including China and members of the European Union. Experts predict these tariffs could slice U.S. economic growth by 2 percentage points this year while pushing inflation to nearly 5%. This dramatic shift has many economists warning that the true impact of these tariffs is still unfolding and could push stock prices further down.

Market analysts had speculated that Trump’s tariff announcements would primarily serve as negotiation tactics rather than formulating permanent policies. However, his remarks indicate a more serious approach, hinting at an intention to repatriate manufacturing jobs to the U.S., a process that could be prolonged and economically painful.

Reactions and Future Outlook

In response to the market's nosedive, Trump expressed confidence, stating, “I think it’s going very well,” likening the economic situation to a patient undergoing surgery. He suggested that the turmoil was anticipated, signaling his belief that the market would ultimately stabilize.

The Federal Reserve's role amidst this chaos could play a critical part; rumors abound that it may lower interest rates to bolster the economy—something it had done prior to pausing in 2025. Falling Treasury yields reflect the rising probability of rate cuts; the yield on the 10-year Treasury nosedived to 4.04% from 4.20%, although concerns remain about rising inflation as the economy grapples with both external pressures and internal consequences from tariff implementations.

Labor Market Signals

On the ground, reports show that while the economy is still growing, signals such as fewer unemployment claims are mixed. Analysts had expected an uptick in jobless claims, which didn't materialize, but confidence in the labor market remains fragile, especially in light of economic uncertainties.

Company Losses

As the dust settled on Wall Street, notable companies suffered severe losses. Best Buy plunged 17.8%, reflecting the international nature of its electronics supply chain. Airline stocks took a hit as United Airlines fell 15.6% amid concerns that economic instability could deter travel. Similarly, Target's shares tumbled 10.9%, as consumers already grappling with inflation could be further squeezed by impending price increases.

Global Market Reaction

Globally, the sell-off was widespread, with Europe and Asia sharing in the downturn. France's CAC 40 dropped 3.3%, while Germany's DAX lost 3%. Japan’s Nikkei 225 fell 2.8%, demonstrating the global interconnectedness of market economies reliant on stable trade relations.

As the financial community contemplates the implications of these tariffs, one thing is clear: we are witnessing a pivotal moment that could reshape economies across the globe. Will the markets find a way to rebound, or has the trade war ushered in an economic downturn that will resonate for years to come? Buckle up—the rollercoaster ride has only just begun!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)