The Ultimate Guide to Private Property Prices in 2025: Insights by MRT Station and PSF

2025-03-24

Author: Mei

The Impact of Location

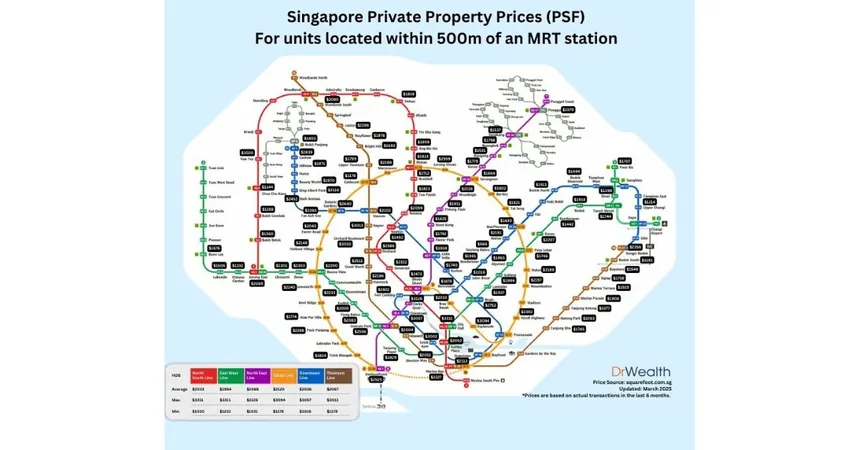

While the proximity to MRT stations significantly influences property prices in Singapore, it's essential to recognize that location isn't the sole determinant. High accessibility to public transport typically increases demand, thereby raising PSF prices. However, various factors contribute to price discrepancies among properties near different MRT stations.

Key Factors Influencing PSF Prices

1. The Surge of New Launches Newly launched properties tend to command higher PSF rates due to their modern amenities, attractive layouts, and the premiums set by developers. For instance, a recently launched condo near a suburban MRT may exhibit a higher PSF compared to an older resale unit in a more central locale. The mix of new and resale transactions can skew average PSF figures depending on recent sales.

2. Unique Condo Features Not all condominiums are created equal, and features that distinguish them can significantly affect pricing: - Tenure: Freehold properties generally attract a premium over their 99-year leasehold counterparts, particularly in established neighborhoods. - Amenities: Developments equipped with extensive facilities, such as pools, gyms, and concierge services, are usually priced higher. - Developer Reputation: Established developers can elevate market interest and pricing for flagship projects.

3. Understanding the Market Structure Singapore's private property market is categorized as follows: - Core Central Region (CCR): Areas like Orchard and Marina Bay command the highest PSF due to their prestige and limited supply. - Rest of Central Region (RCR): Encompassing regions like Queenstown and Bishan, prices here sit between CCR and suburban locations, appealing to buyers seeking a balance of accessibility and affordability. - Outside Central Region (OCR): Suburban areas such as Punggol and Jurong typically offer lower PSF prices; however, new launches in desirable OCR locales can still drive prices significantly higher.

Important Considerations When Assessing PSF Data

The provided map serves as an excellent reference for understanding property pricing trends near MRT stations. However, context is key: - Mix of New and Resale Properties: Areas with recent launches may show inflated PSF averages. - Project-Specific Aspects: Different properties adjacent to the same MRT can vary drastically in price based on their specifications. - Lease Tenure: Freehold and leasehold properties differ substantially in pricing, even when located near each other. - Market Timing: Economic factors such as interest rates and buyer sentiment also play pivotal roles in shaping the market.

Final Thoughts: Start Smart but Dig Deeper

Using this map as a visual reference is a great starting point, but it shouldn’t be the only tool for making property decisions. If you're contemplating purchasing private property—either for residence or investment—consider the following: - Financial Considerations: Evaluate your financial standing, including loan eligibility, monthly repayments, and the potential impact of rising interest rates on overall affordability. - Future Growth Potential: Investigate upcoming infrastructure initiatives and urban planning developments that may influence property values. - Property-Specific Evaluations: Assess essential features such as the quality of amenities and the reputation of the developer. - Integration with Financial Goals: Ensure the property aligns with your broader financial objectives, including current investments and future retirement planning.

Whether you're looking to buy your first home, upgrade, or delve into investment opportunities, informed decisions begin with gathering data, but that's just the beginning. Take the time to analyze details, evaluate your options, and align your property decisions with your long-term aspirations. Making the right choices in today's market could lead to significant rewards tomorrow—don't miss out!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)