Ray Dalio Warns: Americans Are Silent About a Looming Economic Crisis!

2025-09-04

Author: Ying

The Thought Leaders Are Afraid to Speak Up

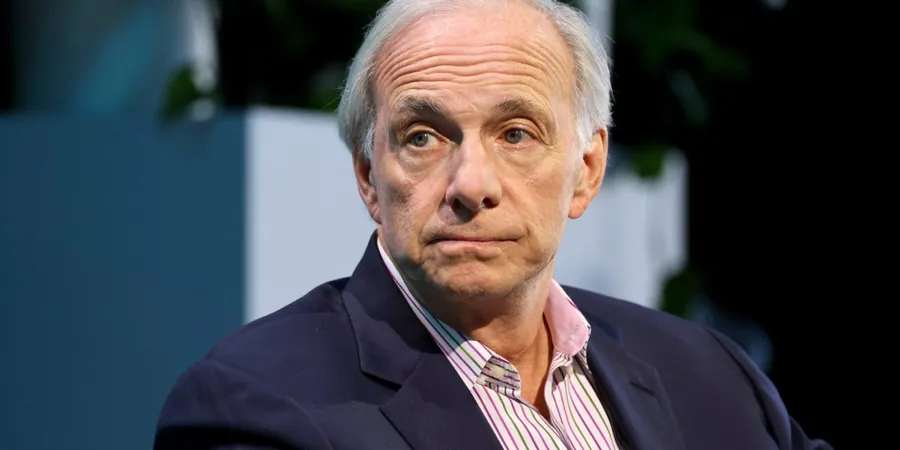

Ray Dalio, the visionary behind Bridgewater Associates—the world’s largest hedge fund managing around $130 billion—has expressed profound concerns about the current state of the U.S. economy. In a candid interview with the Financial Times, Dalio compared today's political and economic landscape to the grim era of the 1930s and 1940s. He highlighted a culture of fear gripping society, as many individuals prefer silence over risking backlash for voicing criticism.

Dalio’s Insights: More Than Just a Hedged Concerns

At 76, Dalio isn't just any financial expert; he built Bridgewater from humble beginnings in a two-bedroom apartment in 1975, crafting it into a financial powerhouse that caters to institutional clients, including governments and pension funds. His reputation rests on an acute understanding of the economy, founded on historical analysis of cause and effect, making his warnings particularly noteworthy.

A Debt Crisis on the Horizon?

Dalio warns of a potential "debt-induced heart attack" looming over the U.S. economy in the near future, possibly within three years. The alarming truth is that America’s national debt has skyrocketed to an eye-popping $37 trillion, which equates to about 124% of the nation's GDP—levels last seen during World War II! If spending continues unchecked, the Congressional Budget Office anticipates the debt-to-GDP ratio could soar to 156% by 2055.

Interference and Economic Control

Concern also arises from the current administration's apparent meddling with Federal Reserve independence. President Trump’s public critiques of Fed Chair Jerome Powell and attempts to displace Governor Lisa Cook send ripples of worry through financial circles, with experts like Christine Lagarde warning that this could seriously jeopardize global economic stability. Additionally, Dalio pointed to the government's investment in chip giant Intel as a symbol of escalating state intervention, echoing fears of autocratic economic control reminiscent of earlier turbulent times.

The Immediate Economic Indicators: An Illusion?

While inflation has cooled to 2.7% as of July, and unemployment sits at a relatively low 4.2%, the job market has shown signs of fatigue, with only 73,000 positions added in July—the weakest growth in months. The Conference Board’s Leading Economic Index has flagged a decline for half a year, hinting at potentially softening economic conditions ahead. The real GDP growth forecast for 2025 stands at just 1.6%, lagging behind historical norms. Caught between higher interest rates and simmering trade tensions, the economic outlook appears troubling.

The Perils of Silence

Dalio's call for more open discourse reflects a broader concern that silence amongst business leaders and investors could exacerbate the nation’s fiscal woes. The dread of facing political or economic repercussions stifles necessary conversations that could avert a crisis. He drew parallels with the sudden market upheaval triggered by former British PM Liz Truss’s ill-fated tax cuts, which led to a historic drop in the pound.

Will History Repeat Itself?

As the U.S. stands on the brink of potential turmoil, Dalio's insights hint that economic health hinges on the bravery of leaders—both political and financial—to confront the unsustainable trends besieging the nation. Whether we will face the dire fallout of a "debt-induced heart attack" may ultimately rest on breaking the silence that now engulfs critical economic conversations.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)