Major Federal Reserve Rate Cut Today: What It Means for Your Wallet!

2024-11-07

Author: Ling

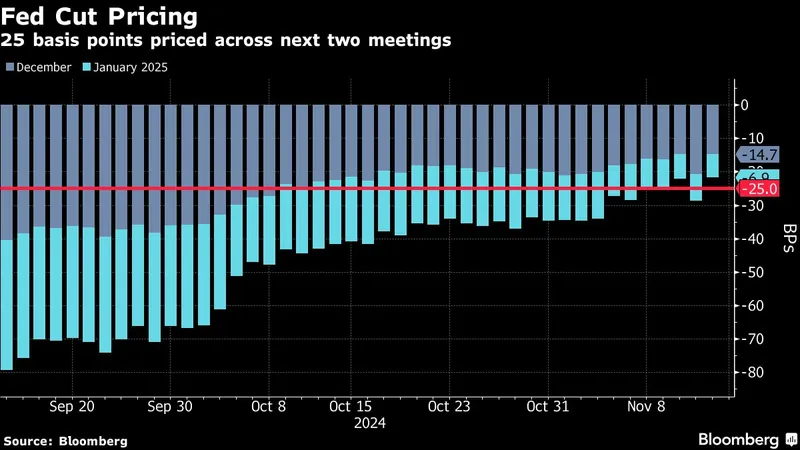

Today, the Federal Reserve is widely anticipated to announce its second interest rate cut of the year, following a surprising jumbo reduction just two months ago in September. Economists expect the Fed to reduce borrowing costs by 0.25 percentage points, moving the federal funds rate from its current level of 4.75%-5% down to a range of 4.5%-4.75%.

This decision comes as the Fed's favored measure of inflation eased to 2.1% last month, coming within striking distance of its 2% target. The central bank is gradually navigating away from the stringent monetary policies put in place during the pandemic that were needed when inflation soared to a 40-year high. The previous high borrowing costs made essential purchases like homes and cars increasingly expensive for consumers.

While the impending rate cut may provide consumers with some relief, experts caution that the immediate impact will be modest. However, continuous rate adjustments in upcoming meetings could potentially lead to significant savings for borrowers over time. “Once a few more cuts happen over the next few months, the impact will accumulate to something that truly assists individuals grappling with debt,” says Matt Schulz, chief credit analyst at LendingTree. “For now, the effect of these cuts might be less noticeable.”

What to Expect from Today's Fed Meeting:

1. **Expected Rate Cut:** Economists predict a 0.25 percentage point cut in the benchmark rate today, November 7. 2. **Future Rate Cuts:** EY chief economist Gregory Daco foresees continued reductions, projecting further cuts of 0.25 percentage points at each Fed meeting through June 2025. This could bring the federal funds rate down to as low as 3.4%. 3. **Timing of the Announcement:** The Fed will reveal its decision at 2 p.m. ET today, followed by a press conference led by Fed Chair Jerome Powell at 2:30 p.m. ET.

4. **Impact of Elections:** This is the first rate announcement post the recent elections, which saw former President Donald Trump returning to office. There’s speculation on how his policies may affect inflation and the Fed's decision-making. If his administration reignites inflation, the Fed might have to reverse course on rate cuts and increase rates instead.

Expectations for 2024:

Looking ahead, the Fed is anticipated to cut rates to a range of 4.25%-4.5% in December, reflecting a full percentage point reduction since September. However, it’s important to note that this doesn’t directly translate to lower mortgage or credit card rates due to the way lenders operate. Credit card interest rates, while slightly reducing, still remain near record highs.

Will Mortgage Rates See Relief?

Despite recent cuts, mortgage rates have actually risen in the past month, with the average rate on a 30-year fixed loan now around 6.72%, compared to a low of 6.08% seen in September. The relationship between the Fed's interest rates and mortgage rates is influenced by various factors, including overall economic conditions and investor sentiments regarding U.S. debt. As long as there are concerns regarding economic stability and future debt, it will be challenging for mortgage rates to decline significantly and remain low.

In summary, while today’s rate cut is a positive step, its immediate benefits may be limited. Borrowers should stay informed and prepared for gradual changes rather than instant relief in their borrowing costs. Keep an eye on future Fed meetings for further developments that could impact your financial wellness!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)