Stocks Plummet as Post-Election Optimism Wanes: What This Means for Investors

2024-11-15

Author: Yan

Stocks Plummet as Post-Election Optimism Wanes

In a surprising turn of events, the stock market experienced a significant downturn today, as the initial euphoria following the recent election begins to lose its luster. Analysts had anticipated a prolonged rally, fueled by hopes of economic recovery and new policies that could stimulate growth. However, as reality sets in, uncertainties are creeping back into the markets, leaving investors anxious.

Reports indicate that major indices, including the S&P 500 and the Dow Jones Industrial Average, dropped sharply, with many sectors seeing red across the board. The decline comes as policymakers face challenges in implementing their proposed agendas, raising concerns about potential gridlock in Congress. As discussions around fiscal stimulus falter and inflation worries loom, market sentiment has shifted dramatically.

Experts suggest that investors should brace for volatility in the coming weeks. “The initial excitement around the election results led many to overlook underlying issues, such as inflation fears and supply chain disruptions," said a market analyst. “Now that those concerns are surfacing, it’s essential for investors to reassess their portfolios.

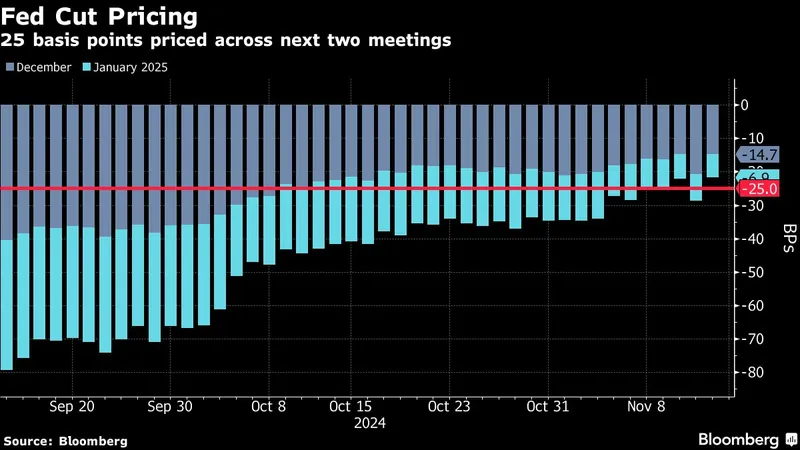

Furthermore, global market influences cannot be ignored. International concerns, including ongoing geopolitical tensions and the effects of monetary policy decisions made by the Federal Reserve, are adding to market instability. Investors may want to keep a close eye on these developments as they might impact not only domestic markets but also global economic dynamics.

Is the post-election rally truly over, or is this merely a temporary setback? One thing is certain: investors will need to remain vigilant and informed as they navigate through these choppy waters. The real question remains—how long will it take for the markets to regain their footing? As the drama unfolds, staying ahead of the curve is key.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)