Intel Corporation (INTC) Sees Remarkable Surge Amid Acquisition Buzz!

2025-01-18

Author: Wei

Intel Corporation Sees a Stock Price Surge

Intel Corporation (NASDAQ: INTC) experienced a phenomenal stock surge of 9.25% on Friday, closing at $21.49 per share. This remarkable increase comes on the heels of swirling rumors regarding a potential acquisition by a major undisclosed company, sparking interest and optimism among investors.

Market Rally Boosts Intel's Performance

On a day that saw the entire stock market rally, with the Dow up 0.78%, the S&P gaining 1%, and the Nasdaq jumping 1.51%, Intel was certainly one of the top performers. This surge was further fueled by a prevailing bullish sentiment as cryptocurrency stocks, particularly focused on Bitcoin mining, also saw significant gains influenced by anticipated positive changes in regulations led by the incoming President-elect Donald Trump.

The Broader Context of Intel's Surge

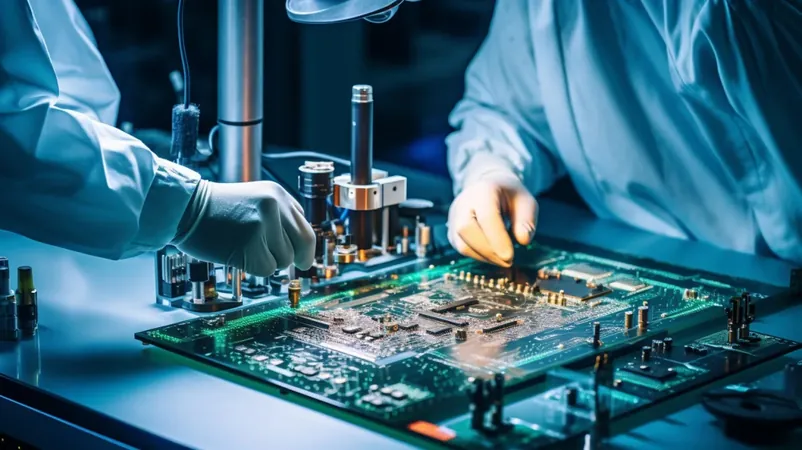

Intel's recent upswing can be attributed not only to the acquisition buzz but also to the broader context of the semiconductor industry. Intel has historically been the dominant player in chip manufacturing but has faced stiff competition and challenges in recent years due to rapid technological advancements and shifts in market demand.

Leadership Challenges at Intel

The company was rocked last month when CEO Pat Gelsinger was ousted after the board expressed a loss of confidence in his strategy to turn the company around.

Speculation on Potential Acquisitions

Reports have previously surfaced regarding interest from Qualcomm and Arm Holdings in potentially acquiring parts of Intel’s business. Qualcomm's conversations about an acquisition reportedly fizzled out, while Arm Holdings was declined interest in purchasing Intel’s product division. These instances highlight the ongoing speculation and uncertainty surrounding Intel's future direction.

Intel's Role in U.S. Semiconductor Production

Moreover, Intel is strategically positioned within the framework of the CHIPS and Science Act, signed into law by ousted President Joe Biden in August 2022. This legislation aims to revitalize domestic semiconductor production in the U.S., a goal that Intel is at the forefront of, emphasizing the importance of enhanced local chip production for national security.

Future Outlook for Intel

As the semiconductor sector evolves and consolidates, Intel's potential acquisition could reshape its future and open up exciting new avenues for growth and innovation. Investors are keeping a close watch on Intel’s next moves as the company struggles to reclaim its former glory in a drastically transforming tech landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)