China's Economic Strategy: A High-Stakes Showdown with Trump and Its Implications for Global Markets

2025-01-16

Author: Kai

China's Economic Strategy: A High-Stakes Showdown with Trump and Its Implications for Global Markets

As the world focuses on the upcoming tensions between China and former President Donald Trump, the implications for the yuan and global stock markets are major talking points. With Trump’s resurgence in American politics, experts are bracing for potential confrontations that could impact trade negotiations and currency stability.

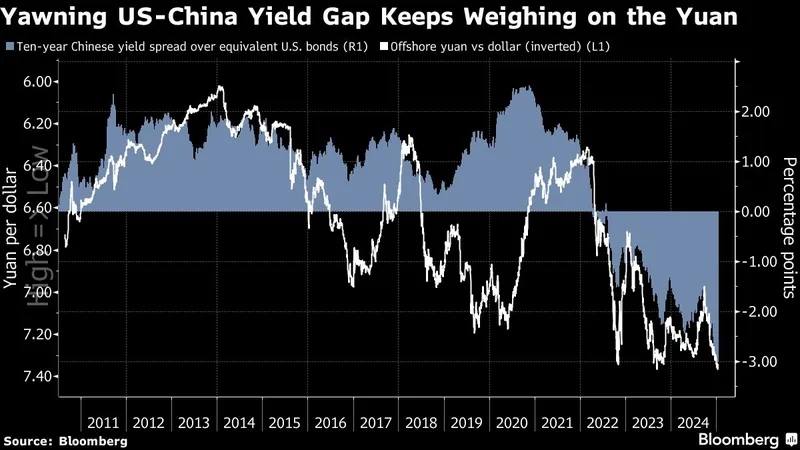

China’s economy, now the second-largest globally, is maneuvering to protect its interests against the backdrop of Trump’s potential return. The yuan, China's official currency, is under scrutiny as it faces pressures not just from domestic economic strategies but also from international economic policies that could be influenced by a Trump administration.

The stakes are high: analysts warn that if Trump were to reclaim power, he could revive his tough stance on China, reinstating tariffs that could destabilize markets and further strain relationships. This could lead to a significant depreciation of the yuan, adversely affecting China's export-driven economy and raising concerns about stock market volatility both domestically and internationally.

Moreover, as the U.S. continues to grapple with inflation and economic recovery, the response from the Chinese government could influence global markets. Investors are closely watching for indicators on how Chinese policymakers might react to potential geopolitical tensions.

This developing situation serves as a reminder of the intertwined nature of global economies. Stakeholders must remain vigilant, as the outcomes of this showdown could send ripples through financial markets, affecting investments far beyond China and the U.S.

Stay tuned for further updates as this situation evolves—it's a financial battle you won’t want to miss!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)