Trump's Tariff Threat Looms Over Canadian Auto Parts Suppliers Amid EV Transition Turmoil

2025-01-19

Author: Charlotte

Introduction

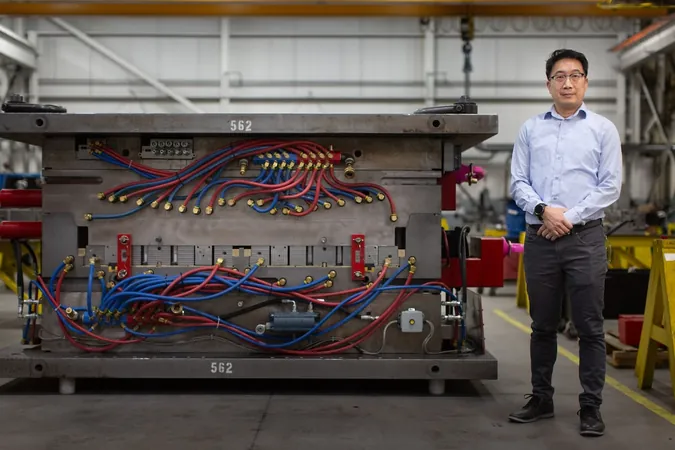

As the automotive industry witnesses a dramatic shift toward electric vehicles (EVs), Canadian auto parts suppliers are navigating a tumultuous landscape marked by sweeping changes and uncertainty. Saylo Lam, who leads the Canadian Association of Mold Makers, represents numerous manufacturers in southwestern Ontario facing unprecedented challenges during this critical transition.

Challenges Faced by Canadian Suppliers

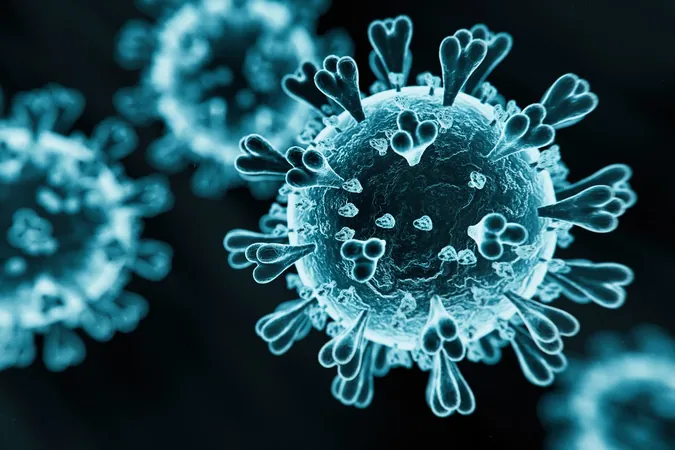

The upheaval comes in the wake of a series of unforeseen global events, including the COVID-19 pandemic, supply chain disruptions, and escalating trade tensions with China. These factors have left many suppliers vulnerable to the strategies and decisions of major automakers, particularly with the impending threat of U.S. tariffs introduced by President Donald Trump, which could reach as high as 25% on Canadian exports.

Potential Impact on the Automotive Ecosystem

Lam highlights the resilience built from enduring these challenges, but the potential fallout from a sudden decline in demand from U.S.-based clients could be catastrophic for many parts suppliers. "It would be devastating," he admits, referring to the broader implications for the already strained North American automotive ecosystem.

Economic Significance of Canadian Auto Parts

As Canada is home to hundreds of auto parts manufacturers employing around 100,000 workers and generating approximately $35 billion in revenue annually, the possibility of tariffs adds significant pressure. The impending tariffs may not just hit parts suppliers; major automakers like Ford, Honda, General Motors, Stellantis, and Toyota could also face increased production costs, complicating their attempts to capture market share in the competitive EV space.

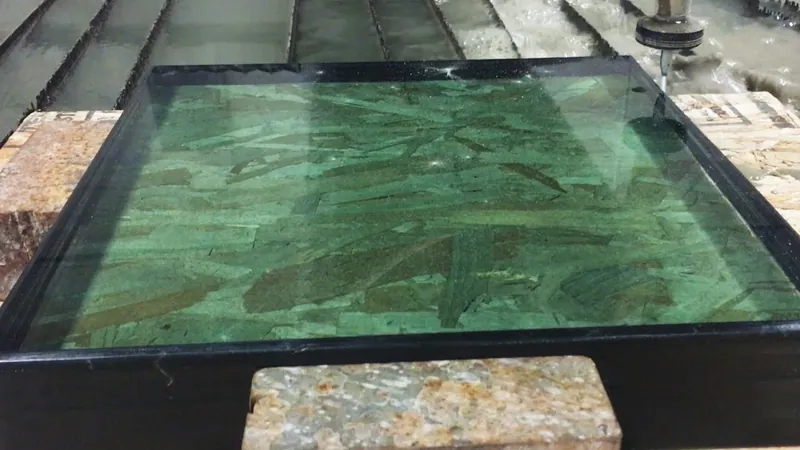

Progress in EV Battery Production

According to reports from recent site visits, the ongoing development of large EV battery plants in Ontario is progressing well, despite the looming tariffs. Stellantis and LG Energy Solution’s Windsor facility is already in operation, while Volkswagen's site in St. Thomas is set to commence production by 2027. Nevertheless, smaller suppliers are likely to bear the brunt of any imminent tariffs, as they are more susceptible to shifts in client demand and project cancellations.

Impact on Smaller Suppliers

Flavio Volpe, president of the Automotive Parts Manufacturers' Association, emphasizes that larger players in the industry might have the resources to withstand short-term challenges better than smaller firms. In contrast, smaller Tier 2 companies that provide parts to larger manufacturers often experience cascading impacts from production delays or cancellations.

Example of Resilience in the Industry

Linamar Corp., the second-largest auto parts maker in Canada, illustrates this resilience. Despite facing setbacks, the company has adopted a strategic focus on flexible, non-EV-specific investments, allowing it to absorb shocks that many smaller firms cannot endure. Linamar's executive chair, Linda Hasenfratz, noted that while some competitors falter, her company has capitalized on their misfortunes by acquiring assets from struggling entities.

Future Outlook and Industry Trends

As the automotive landscape continues to evolve, industry experts predict further consolidation is on the horizon. Smaller businesses, grappling with these "tectonic forces," are left to adapt quickly in a marketplace that may be shifting under their feet.

Conclusion

While Lam and others are cautiously optimistic, the overarching sentiment hinges on Trump's tariffs' uncertain fate and the broader economic impacts these changes could trigger. If enforced, the implications for both Canadian and U.S. auto parts suppliers could be deeply felt, prompting hopes that cooler heads will prevail in the trade arena.

Final Thoughts

The stakes are high for the entire North American auto sector as it strives to pivot towards electrification while facing potential tariffs and regulatory changes. The scramble for a prosperous future in the EV arena continues, but every player on this highway must stay vigilant to navigate the bumps ahead.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)