Trump's Stock Market Bragging Rights are Overrated: Here's Why

2025-09-08

Author: William

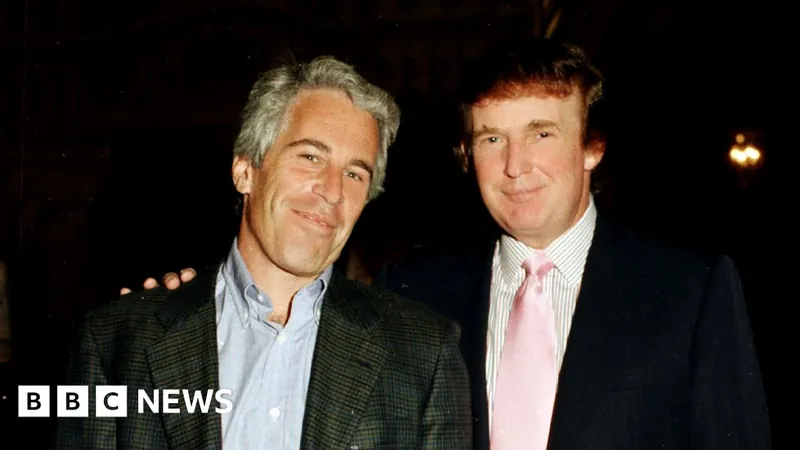

Donald Trump is notorious for his intolerance of criticism. Whether it's from the media, legal arenas, business moguls, or political rivals, his knee-jerk reaction is to retaliate. If given the chance, he'd threaten lawsuits or even fire individuals who challenge him. And when that’s not an option, he wields social media like a weapon, aiming to tarnish reputations.

But there are two notable exceptions to this pattern. The first is his loyal MAGA base; Trump is acutely aware of any signs that he may be distancing himself from his core supporters, especially as he contemplates another run for the presidency in 2028. Recently, he hinted at his ambitions, stating he 'probably won't' seek a third term, yet claimed he has 'the best poll numbers he's ever had'.

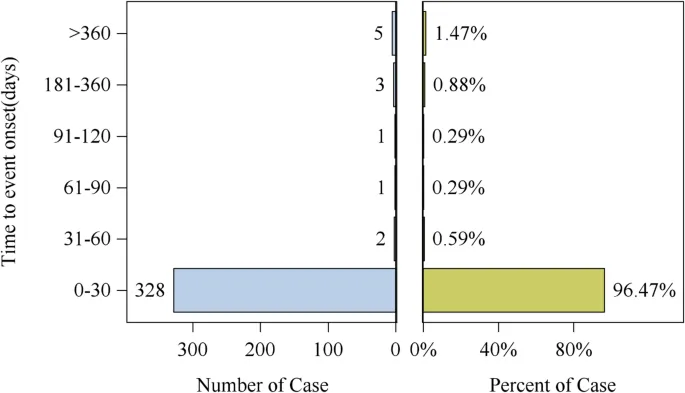

The second exception directly ties to his perception of stock market performance as a reflection of his success in office. During a particularly rough day after his controversial 'Liberation Day' at the White House, stocks took a hit. The Trump administration quickly recalibrated, postponing new tariffs in favor of favorable one-on-one trade negotiations.

Despite the strategies paying off with market recovery, there's a troubling trend that Trump might overlook. If he compared the U.S. stock performance to other countries, he would find a stark reality: American stocks are lagging behind multiple nations.

Take Canada as a prime example. The S&P/TSX Composite has surged by an impressive 17.48% this year, eclipsing the S&P 500's 10.2% gain by a staggering 7.28 percentage points.

Curiously, this positive trajectory occurs amidst warnings of a potential recession in Canada and respectable growth in the U.S. economy. One key factor contributing to the strength of the TSX is the resilience of Canada’s exports, despite Trump's trade tariffs—though job creation remains sluggish, particularly among youth.

But what’s behind the TSX’s outperformance? A significant driver is the surge in gold, with the TSX Global Gold Index skyrocketing 91%. While gold stocks have limited weight in the overall index, financial stocks, which constitute roughly a third of the TSX, have helped pull the lever—with this sector seeing a year-to-date increase of 15.67%. Technology is also thriving, boasting a 20.21% jump, while the beleaguered Telecom sector shows promising growth at 15.85%.

And Canada isn’t the only market outperforming the U.S. As of early September, the UK’s FTSE 100 was up 12.41%, Hong Kong’s Hang Seng Index surged by 25%, and Germany’s DAX achieved a solid 20% increase.

With U.S. stocks trailing the TSX and various other global indices, one has to wonder—how long can Trump's self-assessment of economic prowess remain unchallenged?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)