Market Movers: Boeing, Nvidia, Tesla, BYD, and More Stocks to Watch Ahead of Fed Announcement

2025-03-19

Author: Charlotte

Stocks experienced a modest rally on Wednesday as investors prepared for the Federal Reserve’s interest rate announcement scheduled for 2 p.m. ET, followed by a press conference with Fed Chair Jerome Powell at 2:30 p.m. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all reflected positive gains by 10:52 a.m., with most of the "Magnificent 7" tech stocks gaining traction, with the exception of Meta Platforms (META).

Market analysts predict that the Federal Reserve will likely maintain interest rates at the current level of 4.5%. However, attention is poised on the "dot plot" of the board members' forecasts for future rate changes, as well as any adjustments to the central bank's economic outlook. Comments from Powell will be particularly scrutinized, especially considering the evolving economic landscape.

While some economists foresee potential rate cuts—perhaps starting as early as the current meeting—others believe that stickier inflation may compel the Fed to hold off on any changes for an extended period. This divide creates an atmosphere of uncertainty in the market.

Key Stocks in Focus:

Autodesk (ADSK)

The stock surged by 3.9% following news that activist investor Starboard Value intends to initiate a proxy battle at the design-software company. This move has raised hopes for strategic changes within the firm that could unlock shareholder value.

Boeing (BA)

Boeing shares jumped more than 6% after CFO Brian West expressed optimism at the Bank of America Global Industrials Conference, affirming that the company is aligned with its key performance indicators for the year. Investors view this as a positive sign of recovery for the aerospace giant.

General Mills (GIS)

In contrast, shares of General Mills slid by 1.6% after the company reported quarterly revenues that fell short of expectations. Additionally, the firm revised its sales forecast downward, indicating potential challenges ahead in the food industry.

Gilead Sciences (GILD) and GSK

Stocks of Gilead fell 3.8% after Politico reported on potential budget cuts to domestic HIV prevention efforts under the Trump administration. Similarly, GlaxoSmithKline (GSK) shares decreased by about 2%, reflecting investor concerns regarding healthcare funding.

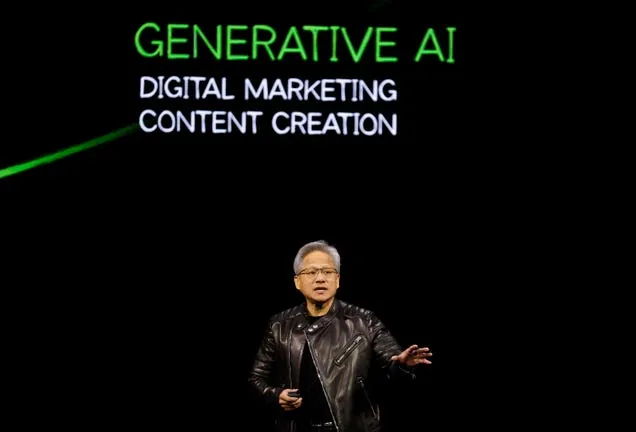

Nvidia (NVDA)

Nvidia's stock gained 1%, buoyed by its ongoing AI conference in San Jose. Although CEO Jensen Huang's keynote address did not meet high expectations—particularly amidst a tech-stock selloff—he did announce an exciting partnership with General Motors (GM) to advance self-driving car technology.

Tencent (TCEHY)

Shares of Tencent rose approximately 0.7% after the Chinese tech titan reported better-than-expected quarterly sales and profits, alongside news of increased investment in AI technologies, signaling its ambition to stay ahead in the competitive landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)