Is Canada’s Lifespan Crisis Here? Shocking Reasons Why We’re Stalling

2025-09-07

Author: Noah

The Unexpected Plateau in Canadian Life Expectancy

For over a century, Canadians relished the uplifting narrative of rising life expectancies. This belief shaped our retirement plans and even influenced government policies, like Stephen Harper's decision to raise the Old Age Security pension age from 65 to 67. But now, this comforting trend is facing a dramatic shift.

The Latest Data: A Cause for Alarm?

Recent statistics reveal a troubling reality: life expectancy in Canada has plateaued. Whether measured from birth or from age 65, the numbers are startling. By 2023, life expectancy from age 65 remained stagnant since 2016, while life expectancy from birth actually dipped compared to 2012.

Decoding the Decline: Factors at Play

As we examine this significant turnaround, several critical factors emerge. First and foremost, the COVID-19 pandemic undeniably impacted overall life expectancy, particularly during the years 2021 and 2022. However, that’s just the tip of the iceberg.

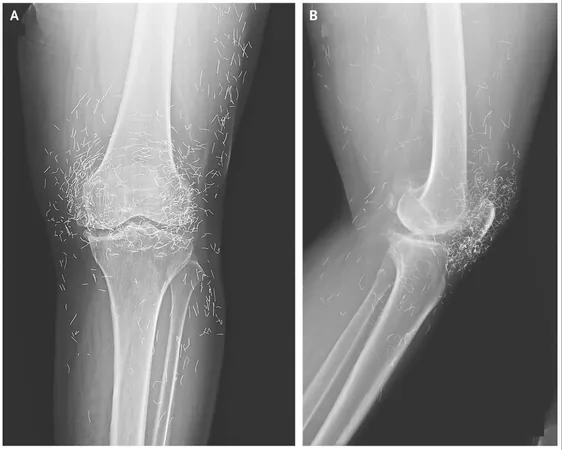

Medical breakthroughs traditionally extended life, but it seems we've tapped into the easier advancements, leaving us with tougher challenges ahead. Furthermore, the opioid crisis, especially the alarming rise in fentanyl use, contributes to an increase in younger fatalities. The chilling statistic of 7,146 toxicity deaths in 2024 highlights how these tragedies disproportionately affect age groups typically shielded from such high mortality.

A Controversial Consideration: Euthanasia's Impact

Another layer to this complex issue is the legalization of euthanasia in Canada, known as Medical Assistance in Dying (MAID), which commenced in 2016. This policy now accounts for 1 in 20 deaths, introduce complexities that may be influencing our longevity metrics.

The Future: What Lies Ahead for Life Expectancy?

Despite these headwinds, a glimmer of hope lingers. Predictions suggest that life expectancy may begin to rise again, albeit at a slower pace than we previously anticipated. This adjustment could have financial implications, especially in sectors like life annuities. Insurance companies often overestimate future improvements in mortality, which could lead to unexpectedly high premiums.

Similarly, shifts in mortality rates may impact benefits from the Canada and Quebec Pension Plans, possibly resulting in a decrease in contribution rates in the near future.

Conclusion: A New Era of Aging in Canada?

As we navigate this new reality of stalled life expectancy, it’s clear that Canada is at a crossroads regarding aging and its implications for society. The challenge now lies in adapting to these changes and ensuring that future generations are supported as they age.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)