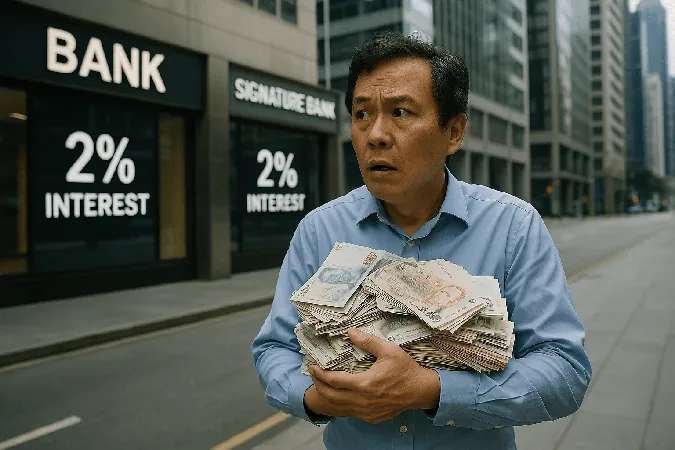

What Should You Invest In When T-Bill and Fixed Deposit Rates Drop Below 3%? Discover the Best Alternatives!

2025-03-29

Author: Wei

Introduction

Gone are the days when parking your cash in fixed deposits or Treasury bills yielded a comfortable 4% risk-free return. As of now, interest rates have plummeted below the 3% mark and are predicted to dip further as global central banks, including the US Federal Reserve, embrace rate cuts to support teetering economies. For instance, the latest Singapore 6-month Treasury bill yield stands at just 2.73%, while conventional fixed deposit rates have also dipped below this threshold. If you’re fishing for higher yields, it’s time to explore uncharted waters. Be prepared, though—this won’t be without its risks. Let’s dive into some viable investment options that could potentially yield better returns.

1. Cash Management Accounts: A Possible Safe Haven

Among alternative investments, cash management accounts remain a noteworthy choice, still capable of offering above 3% returns. The advent of robo-advisors and digital banking has led to some platforms vying for new deposits with attractive offers. Consider the following: - **Endowus**: 2.7% to 3.8% - **StashAway**: 2.5% to 3.6% - **Maribank**: 3.26% - **Syfe**: 2.3% to 3.2% - **Chocolate Finance**: 3.3% These yields are projections—not guarantees—as these accounts typically invest in money market funds composed of short-term bonds and T-bills. This means in a declining interest rate environment, yields could also take a hit. Nevertheless, for now, cash management accounts are still viewed as a low-risk investment avenue.

2. US Treasuries: A Global Opportunity

Despite the recent rate cuts, US Treasuries are still offering yields exceeding 4%, leaving local alternatives trailing behind. However, two critical risks must be considered: Firstly, since US Treasuries are denominated in USD, individuals primarily earning or spending in SGD face currency risk. A depreciation of the USD against SGD—approximately 2% year-to-date—could diminish returns when converted back to local currency. Secondly, there's a looming reinvestment risk as US Treasuries generally mature in 6 to 12 months. Anticipating lower interest rates at the time of reinvestment can erode the yield advantage, leaving investors scurrying for sustainable returns that remain elusive.

3. Bond Funds: A Moderate Option

Looking into bond funds reveals options previously highlighted, offering monthly dividends with yields surpassing 5%. However, investing in these funds comes with considerations of interest rate risk; falling rates can lead to diminishing yields. Moreover, expense ratios may exceed 1%, further curtailing returns. On the upside, if falling rates drive bond prices up, you may reap capital gains along with income—caution is advised in a fluctuating economy characterized by potential stagflation.

4. Real Estate Investment Trusts (REITs) and Dividend Stocks: The Yield Players

Turning towards equities, stocks generally carry more volatility than bonds but can present stable earnings through carefully selected options. Particularly, REITs can be attractive for yield-seeking investors, as they are mandated to distribute significant earnings as dividends. Despite the challenges posed by rising interest rates—having adversely affected many REITs—there are resilient options available for discerning investors. Additionally, financial sector stocks, particularly banks, have performed admirably, reporting unprecedented profits and declaring special dividends amidst rate hikes. For instance, ETFs such as Lion-OCBC Securities APAC Financials Dividend Plus ETF (YYY) are capitalizing on leading banks across Asia and Oceania, achieving a remarkable 13% growth since its launch.

Conclusion: Charting Your Investment Strategy

There’s no one-size-fits-all solution when it comes to navigating today's tumultuous investment landscape. Instead of searching for a magical answer, focus on building a well-diversified portfolio. Consider an amalgamation of cash management accounts, short-term bonds, reliable dividend stocks, and strategic growth opportunities. With a history of enjoying 3-4% yields from secure instruments, it’s prudent to start preparing for the future. Structuring your investments adequately now is vital, especially as rates potentially descend further and the array of options shrinks. Stay informed and proactive, and your investment strategy could thrive amidst shifting tides!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)