Wall Street Dips as Dollar Gains Ground After Bold Fed Rate Cut

2024-09-18

Wall Street's Response to Fed Rate Cut

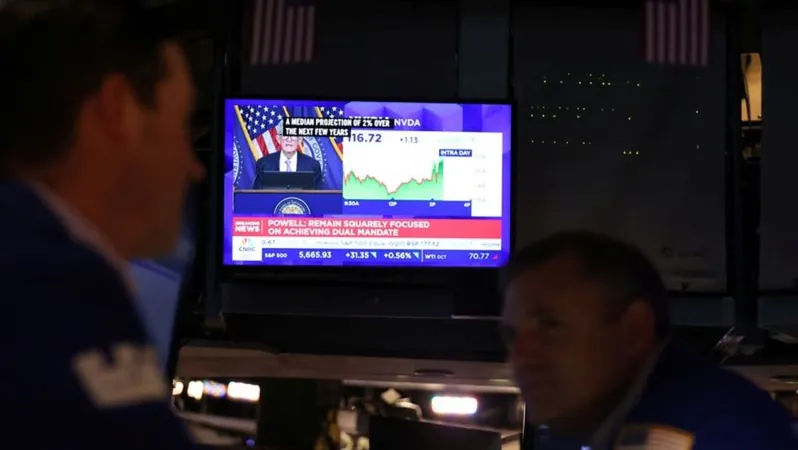

In a surprising turn of events on Wednesday, major stock indexes on Wall Street closed with modest losses despite the U.S. Federal Reserve announcing a significant half-point cut to borrowing costs. This marked the Fed's first move in over four years and showcased its commitment to steering inflation back to its annual target of 2%.

S&P 500 and Other Indexes Performance

With the new overnight rate set at an attractive 4.75% to 5.00%, the Fed indicated a strong confidence in the economy's resilience even as it shifts tactics to manage inflation concerns. Following the announcement, the benchmark S&P 500 initially surged by up to 1% but ultimately finished the day down by 0.29% at 5,618.26. Steve Sosnick, chief market strategist at Interactive Brokers, emphasized the cautious market response, stating, “It’s important to note that stocks are not rocketing ahead (at least not yet) after getting what they wanted. After seven straight up days, a lot of good news was priced in.” Similarly, the Dow Jones Industrial Average slipped 0.25% to close at 41,503.10, and the Nasdaq Composite dipped by 0.31%, ending the day at 17,573.30.

Dollar's Resilience

Despite the rate cuts, which were a response to inflationary pressures and other economic indicators, the dollar showed resilience after a brief dip post-announcement. The dollar index, measuring the U.S. currency against a basket of rivals including the yen and euro, rebounded by 0.07% to 100.98.

Bond Market Reactions

In the bond market, the yields on key U.S. Treasuries reflected the market's shifting dynamics. The yield on 2-year Treasuries rose to 3.6297%, marking an increase of 3.8 basis points, while yields on benchmark 10-year notes climbed 6.6 basis points to settle at 3.708%.

Future Fed Moves

Looking ahead, all eyes are on the Fed's future moves. Explore the implications of Chair Jerome Powell's recent statements, where he noted the absence of recession signals and highlighted the labor market's robust condition. He hinted that earlier intervention might have been on the table had the July jobs report reflected the underlying weakness sooner.

Market Expectations

Market participants are currently pricing in at least a 25 basis point cut at the central bank's next meeting scheduled for November, and intriguingly, there’s a 40% chance of an additional bold 50 basis-point reduction.

Global Market Reactions

As global markets react, key interest rate decisions loom from other major central banks. The Bank of England is anticipated to maintain its current rates in its upcoming meeting on Thursday, while the Bank of Japan is expected to provide similar guidance on Friday.

Foreign Currency Reactions

Post-Fed meeting, foreign currencies reacted accordingly, with the Japanese yen strengthening by 0.11%, bringing it to 142.24 per dollar, while the British pound rose by 0.28% to $1.3193.

Commodity Market Moves

However, commodities faced mixed results. Gold prices faced a slight decline of 0.62% to $2,553.67 per ounce after reaching record highs earlier, while oil prices fell marginally with Brent crude settling at $73.65 a barrel amid concerns over the U.S. labor market's condition.

Conclusion

As investors brace for a turbulent period ahead, the impact of the Fed's aggressive stance on the economic landscape and global markets is set to unfold in the coming weeks! Stay tuned for more updates as we navigate this financial rollercoaster!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)