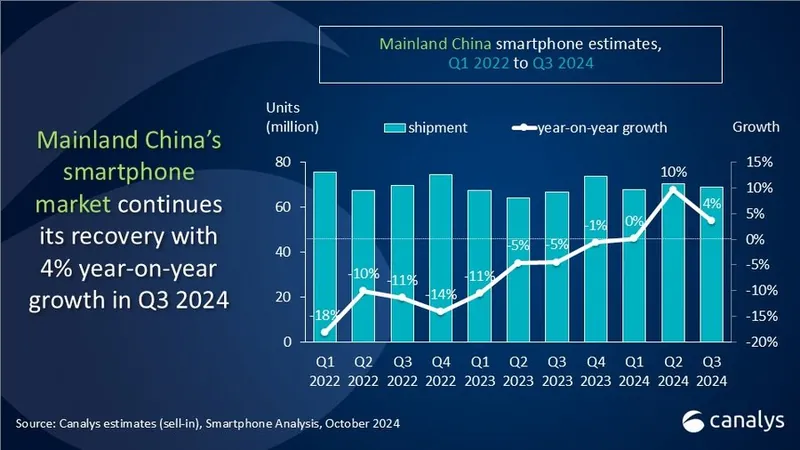

vivo Dominates Mainland China's Smartphone Market as Growth Surges 4% in Q3 2024

2024-10-25

Author: Mei

Mainland China's smartphone market is experiencing a strong resurgence, with a remarkable 4% year-on-year growth in Q3 2024, as reported by Canalys. The rise in shipments, totaling 69.1 million units, can be attributed to seasonal shopping trends, particularly during the summer and back-to-school periods.

Leading the charge is vivo, which has successfully maintained its top position in the market with a commanding 19% market share. The brand's innovative mid-range product launches have significantly boosted offline sales while enhancing its online presence. vivo reported a staggering 25% increase in shipments, reaching 13 million units this quarter alone.

Following closely is Huawei, which secured the second spot with 10.8 million units shipped, translating to a 16% market share and notable growth of 24%. This success stems from an assertive channel strategy that promotes its flagship offerings. Meanwhile, HONOR managed to ship 10.3 million units, placing third, despite experiencing a 13% decline in overall shipments. The brand is grappling with fierce competition, although its new line of foldable devices has gained popularity amid this shift.

Xiaomi has climbed to the fourth position, capturing 15% of the market share by shipping 10.2 million units—a growth of 13%. The company is benefitting from its expansive ecosystem strategy, dubbed “Human x Car x Home,” aimed at connecting with a broader base of consumers.

Surprisingly, Apple snatched the fifth spot despite a 6% drop in shipments. The anticipation surrounding the iPhone 16 series suggests resilience in consumer demand, even in the absence of its Apple Intelligence services in Mainland China.

Canalys Research Manager Amber Liu commented on the current market dynamics, stating, “The Mainland China smartphone market is entering its most active period of the year, with ongoing consumer demand fueled by previous e-commerce sales.” Vendors are gearing up for the upcoming shopping seasons, focusing on mid-range and affordable 5G devices, emphasizing features such as durability and battery life alongside various promotions.

Additionally, Canalys Research Analyst Lucas Zhong highlighted the growing interest in flagship devices, particularly Huawei's Mate XT Ultimate, which has sparked vibrant discussions regarding innovation in foldable technology. As brands explore AI integration, the competition in the flagship segment is expected to intensify.

Looking ahead, Canalys Senior Analyst Toby Zhu anticipates continued moderate recovery of Mainland China’s smartphone market into next year. He pointed out that governmental policies and consumer stimulus measures are set to bolster economic activity. Vendors are keen on innovating, especially in software and AI development, although they continue to face challenges like rising component costs and geopolitical supply chain disruptions.

As the competition heats up, consumers can look forward to a broader array of smartphone options that blend technology with evolving consumer needs. The battle for supremacy in this vibrant market is set to be fierce as brands refine strategies and adapt to the ever-changing landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)