US September Flash S&P Global Services PMI: A Mixed Bag with Surprising Insights!

2024-09-23

US September Flash S&P Global Services PMI: A Mixed Bag with Surprising Insights!

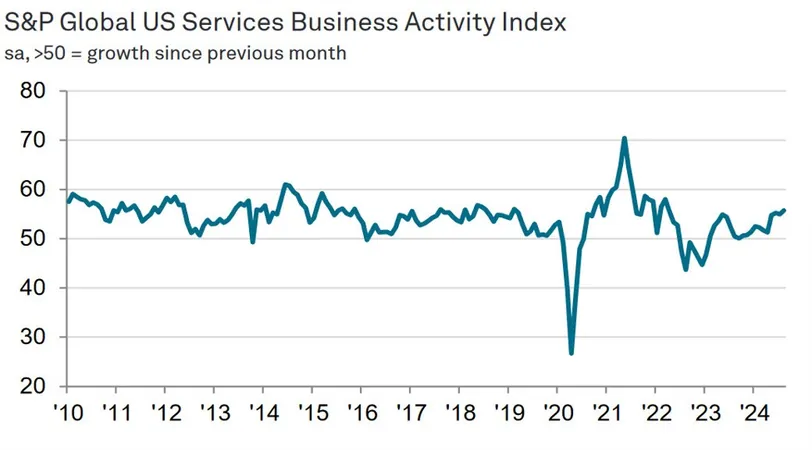

In the latest economic indicators released by S&P Global, the flash Purchasing Managers' Index (PMI) for the services sector in September 2024 revealed a reading of 55.4, slightly above the anticipated 55.2. This comes amidst a backdrop of fluctuating performance across various sectors, with prior readings showing a strong 55.7, marking the best result in two years.

Manufacturing Sector Takes a Hit

While the services sector shows resilience, the manufacturing side is struggling. The manufacturing PMI fell to 47.0, significantly undercutting expectations of 48.5 and down from the previous figure of 47.9. This marks a concerning trend, as any reading below 50 indicates contraction within the manufacturing industry.

Price Pressures Intensify

Additionally, the report highlights an alarming increase in the average prices charged for goods and services, which have surged to their fastest rate since March. The inflation of selling prices in both the manufacturing and services sectors climbed to six-month highs, surpassing long-term averages established before the pandemic.

The service sector is experiencing a year-high rate of cost inflation, often attributed to rising wages amid a competitive labor market. In contrast, manufacturing sector input costs moderated to a six-month low, suggesting a complex dynamic between the two sectors.

Diminishing Confidence and Employment Concerns

Worryingly, optimism regarding future output has taken a hit. The future output index has plummeted to its lowest level since October 2022, signaling deepening uncertainties among business leaders. Moreover, employment figures have dipped for the second consecutive month, with four declines in the past six months, raising fears about job security and economic stability.

Commenting on this complex landscape, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted: 'The early survey indicators for September suggest the economy continues to grow at a steady pace, but the weakened manufacturing sector and increasing political uncertainty pose significant challenges. As inflation reacceleration becomes evident, the Federal Reserve may need to tread carefully in its policy adjustments.'

Williamson also cautioned that the reliance on the service sector for economic growth is becoming increasingly precarious, especially with the lack of momentum in manufacturing. The uncertainty surrounding the upcoming Presidential Election further complicates business sentiment, leading to subdued demand, hiring freezes, and cautious investment behaviors.

Conclusion

As the Federal Reserve evaluates its next move in response to these shifting economic currents, the question remains: Are they fully acknowledging the complex reality of current inflationary pressures and fluctuating business confidence? Only time will tell how these developments will shape the U.S. economy in the coming months.

Stay tuned for more updates as we track this unfolding economic narrative!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)