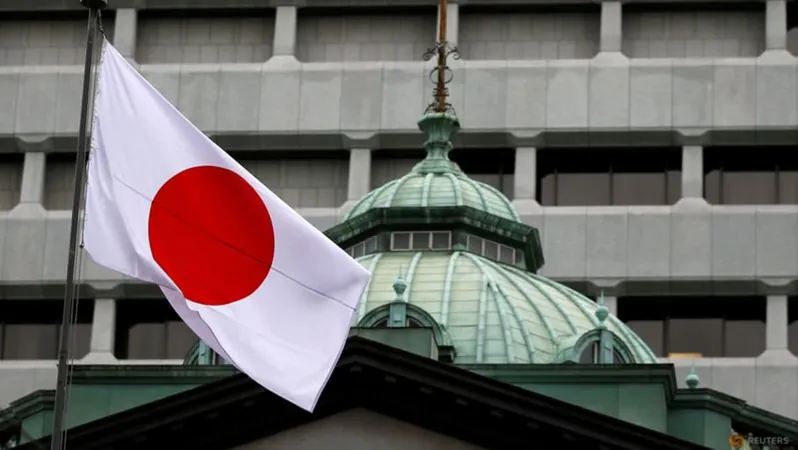

Tokyo’s Japan Activation Capital Secures $512 Million to Fuel Growth in Japanese Firms

2025-03-27

Author: Li

Tokyo’s Japan Activation Capital Secures $512 Million to Fuel Growth in Japanese Firms

In a significant move for Japan's investment landscape, Tokyo-based Japan Activation Capital (JAC) announced on Thursday the successful closure of its second fund, amassing a remarkable 77 billion yen (approximately $511.93 million). This latest fundraising bolsters JAC’s total capital raised from domestic institutional investors to roughly 210 billion yen, positioning the firm as a pivotal player in the Japanese market.

Founded in 2023 by Hiroyuki Otsuka, a notable former executive at Carlyle Group, JAC aims to concentrate its investments on mid- to large-cap listed companies in Japan. The firm partners closely with management teams that share a vision of fostering "private equity style value creation."

The closure of the second fund comes at a crucial time when Japanese authorities are intensifying efforts to invigorate domestic stock market investments. Notably, JAC's first fund, which closed in April 2024, successfully raised 130 billion yen from Japanese mega-banks and insurance providers, showcasing strong support from traditional financial institutions.

This time, the fundraising saw a diversification of its backers, pulling in investments from regional banks, government-affiliated funds, and even a university endowment, reflecting a growing confidence in Japan's business ecosystem. Otsuka emphasized that in a shrinking domestic market, JAC’s commitment to helping firms grow and elevate their market profiles was key to attracting investor interest.

“After engaging with company executives, we ensure our investments happen with their full buy-in. It’s essential for us to strengthen company fundamentals through active collaboration,” Otsuka elaborated in an interview, highlighting JAC's strategic approach.

JAC’s inaugural investment was directed at Lion Corporation, a leading manufacturer of everyday goods such as toothbrushes, soaps, and detergents, made in October 2024, although the specific investment amount remains undisclosed. Following this investment, Lion Corporation's updated medium-term management plan led to an extraordinary 18 percent surge in its stock price, signaling a positive market reaction.

Currently, JAC is in discussions with around 20 companies, with plans to make further investments typically ranging in the tens of billions of yen. "We see a growing trend of a new generation of proactive company managers eager to elevate their business through funds like ours," Otsuka remarked.

As the investment environment in Japan continues to evolve, JAC's aggressive strategy and commitment to partnership could potentially change the dynamics of growth and investment within the country, making it a firm to watch in the coming years.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)