The Rise and Risk of Siberia Taiga: Hong Kong's New Russian Supermarket and the Authenticity Dilemma

2025-03-16

Author: Mei

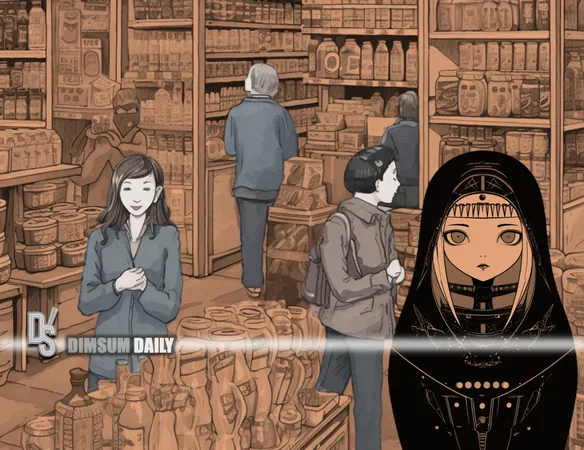

As the geopolitical landscape shifts dramatically, the recent opening of the Siberia Taiga supermarket in Mong Kok, Hong Kong, marks a pivotal moment in Sino-Russian commerce. While this 1,300-square-foot store may seem like just another retail outlet on Sai Yeung Choi Street South, it encapsulates the complex interplay between international relations and consumer culture in a time of rising tensions with the West.

With China's consumer base increasingly turning away from American goods, Russian products are positioning themselves to fill that gap. The boom has been striking: over 2,500 Russian-themed businesses have popped up across China since 2022, and bilateral trade is reaching levels never seen before. Yet, the question of authenticity presents a challenge that has the potential to undermine this burgeoning market.

Siberia Taiga’s offerings range from AK-47-shaped liquor bottles, carrying a hefty price tag of HK$1,599, to premium caviar priced at HK$659 for just 50 grams. However, Hong Kong shoppers are known for their discerning tastes and rigorous evaluations of authenticity, which sets them apart from mainland Chinese consumers who might overlook authenticity in favor of political solidarity.

Investigations by Russian bloggers, such as "Xiao An in China," have unveiled a troubling reality: many products marketed as Russian in mainland stores are actually produced in northeastern provinces of China, complete with shoddy labels and prices that can be inflated by as much as 3,400%. This spotlight on misleading marketing tactics raises significant concerns about the integrity of products sold under the Siberia Taiga brand.

Siberia Taiga’s management is keen to establish a reputation for authenticity, emphasizing direct sourcing from Russia and official certifications. Yet, similar claims from mainland vendors have often fallen flat under scrutiny, causing skepticism about whether Siberia Taiga can indeed keep its promises in a marketplace where verification is notoriously difficult.

The growing partnership between China and Russia has blurred the lines between genuine cultural exchange and opportunistic marketing. With 80% of new Russian-themed businesses still operational in China, it’s clear there is a sustainable demand. However, Hong Kong's unique position as a global financial hub complicates this picture. While mainland consumers may embrace Russian goods as a political gesture, Hong Kong's electorate feels empowered to demand substantive quality and authenticity.

Price points at Siberia Taiga illustrate this tension. Positioned as a premium brand, they signal confidence in Hong Kong shoppers’ willingness to pay for authentic imports. However, history suggests that retaining a premium status while ensuring genuine sourcing could be a daunting task.

Additionally, recent crackdowns by mainland Chinese authorities on misleading Russian-themed stores expose the extent of the problem. In Shanghai alone, inspections of 47 such stores revealed pervasive issues like false advertising and misleading origin claims.

The ambitious plan by the Russian Export Center to establish 300 official stores in China by year's end reflects Moscow's acknowledgment of both the opportunity and its pitfalls. The introduction of a dove-shaped “Made in Russia” label seeks to address authenticity concerns, but reliable implementation and rigorous verification remain elusive.

For Hong Kong consumers, a deeper appreciation of food culture might provide a more stable foundation for authentic Russian imports. Nevertheless, the supermarket's low foot traffic upon opening, partially attributed to inclement weather, suggests a cautious welcome from consumers. Historical data indicates that novelty doesn’t guarantee long-term viability; Siberia Taiga will need to create ongoing value to remain competitive.

The diplomatic presence of Russian Consulate officials at the grand opening underscores the significant interplay between commerce and geopolitics in this venture. As China and Russia further strengthen their strategic partnership, retail undertakings like Siberia Taiga serve dual roles in fostering economic links as well as diplomatic rapport.

Looking ahead, Siberia Taiga's ability to distinguish itself from questionable mainland enterprises will be crucial for its success. Commitment to transparent sourcing, a dedication to genuine Russian products, and reasonable pricing strategies will be essential to earning the trust of Hong Kong's savvy consumer base.

Ultimately, the fate of Siberia Taiga may hinge not merely on geopolitical goodwill but on foundational retail principles such as authenticity, value, and customer satisfaction. If this pioneering Russian retail venture can succeed in Hong Kong, it could become a blueprint for establishing credible Russian commerce across China, navigating the treacherous waters of counterfeiting and market misrepresentation. However, the burning question remains: Can Russian-themed retail thrive solely on genuine products, or is it bound to rely on local manufacturing and innovative marketing strategies? Time will tell, and Hong Kong's experience with Siberia Taiga holds the potential to provide critical insights.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)