Thai Inflation Rate Plummets: What It Means for the Economy!

2025-04-04

Author: Sarah

Thai Inflation Rate Plummets: What It Means for the Economy!

BANGKOK - In a surprising turn of events, Thailand's annual inflation rate has tumbled below 1% in March, with predictions suggesting it could plummet even further in the second quarter. This news comes from the Commerce Ministry, which recently indicated potential adjustments to its inflation forecasts for 2025 but assured the public that the nation is not on the brink of deflation.

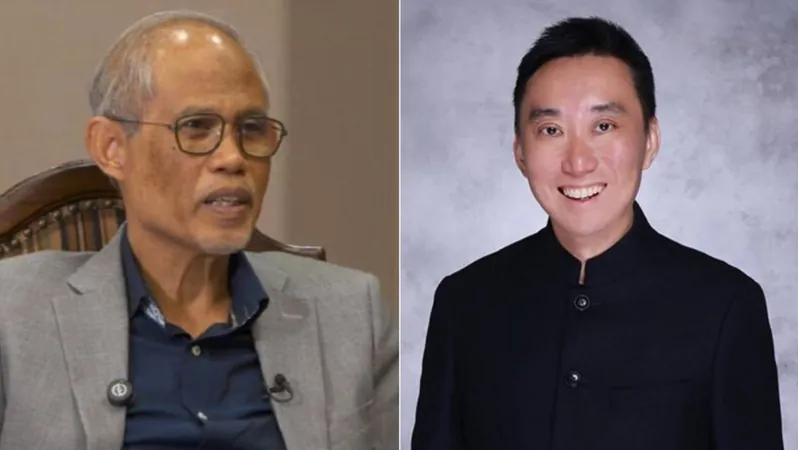

According to Poonpong Naiyanapakorn, the head of the Trade Policy and Strategy Office, the inflation rate is projected to drop to approximately 0.15% in the next quarter, primarily due to decreased energy prices. “We are observing a slowdown in inflation, but thankfully, we are not witnessing deflation as of now,” he stated, easing concerns about economic stability.

The headline consumer price index (CPI) saw a modest rise of 0.84% in March compared to the previous year, falling short of market expectations and now outside the central bank's target range of 1% to 3% for the first time in four months. The core CPI, which excludes volatile items such as food and energy, registered a slightly higher increase of 0.86% in March.

Additionally, the inflation rate averaged 1.08% over the first quarter, modestly underperforming the ministry's forecasts. In light of these developments, Poonpong revealed that the ministry plans to slightly revise its inflation projection for 2025, currently estimated between 0.3% to 1.3%, following last year’s more stable rate of 0.40%.

Interestingly, Poonpong noted that last week's earthquake in Myanmar, which was felt in Bangkok, has not significantly impacted inflation levels. However, it has led to a decrease in rental prices for high-rise housing, which may provide some relief to residents.

In February, the Bank of Thailand responded to the economic landscape by cutting its key interest rate by 25 basis points to 2.00%. As the nation grapples with these evolving circumstances, many economists are predicting that another interest rate cut could be on the horizon during the BOT's next policy meeting on April 30, particularly in light of the recent earthquake and the additional pressures created by U.S. tariffs.

As consumers and businesses brace for changes, the question remains: how will these measures shape the Thai economy moving forward? Stay tuned for further updates!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)