Singtel Sells Digital Wallet Dash to Western Union: What It Means for Users

2024-10-24

Author: Rajesh

In a significant move, Singapore Telecommunications Limited (Singtel) has announced the sale of its digital wallet platform, Dash, to the American financial giant Western Union. Both companies confirmed the deal through a joint press release on October 24.

This strategic decision is part of Singtel's ongoing initiative to streamline its operations and focus on enhancing its core business, ultimately paving the way for improved innovation and growth opportunities. While the details regarding the financial specifics of the sale remain undisclosed, the agreement is conditional and will require regulatory approval before any finalization.

Customers currently utilizing Dash can breathe easy; they will continue to access all existing services without interruption during the transition period. Singtel has reassured that there will be no immediate job losses as a result of this sale. A spokesperson mentioned that all staff would be reassigned either within Western Union or within Singtel itself, ensuring continuity for employees.

Anna Yip, Singtel's Deputy CEO, emphasized the commitment to supporting Dash's customers and business partners throughout this change. She remarked, "We will work closely with Western Union to ensure that our Dash customers and business partners continue to be well-supported and the transition is seamless."

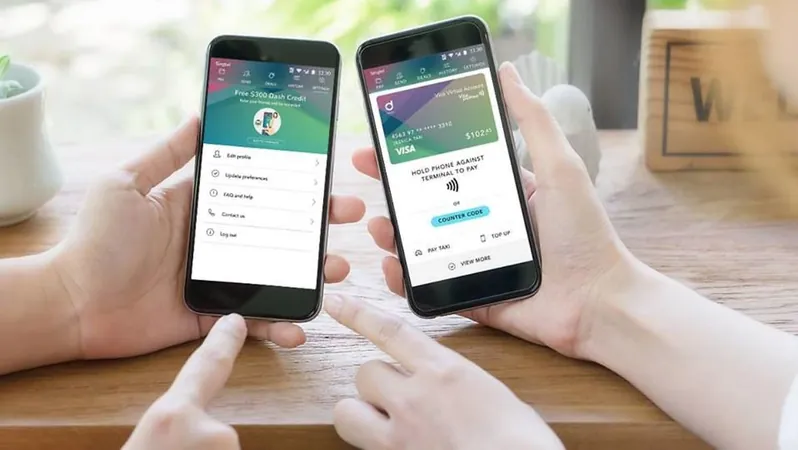

Launched in 2014, Dash has positioned itself as a versatile mobile wallet offering a variety of financial services, including payments and remittances. It has gained significant traction, boasting a customer base of over 1.4 million users. The platform facilitates remittance to more than 35 countries, catering especially to those sending money to family and friends in regions like Indonesia, the Philippines, and Australia.

This acquisition by Western Union aligns with the company’s growth strategy to expand its digital transaction services in the Asia-Pacific market, leveraging Dash's established user base and capabilities. As digital payments continue to gain traction globally, this deal is likely to sharpen competition within the sector, potentially resulting in enhanced services for consumers.

Stay tuned as we monitor the development of this acquisition and its impact on the digital payment landscape!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)