Singapore Unveils 24/7 Anti-Scam Hotline to Combat Rising Fraud Cases

2024-09-27

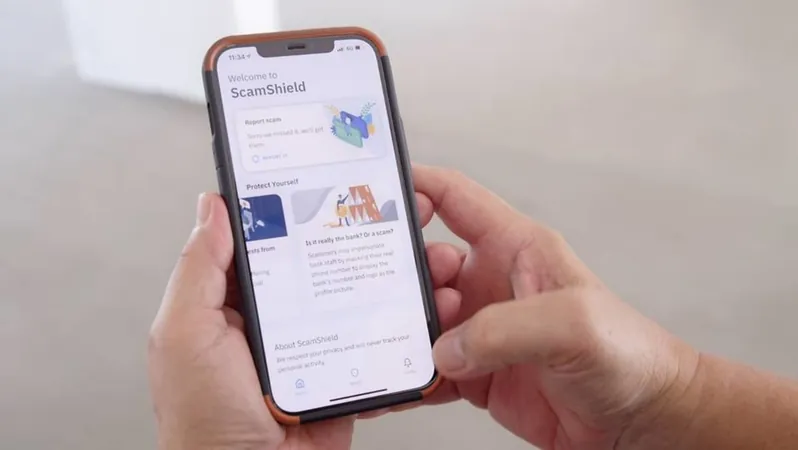

In a bold move to tackle the escalating threat of scams, Singapore has officially launched a 24-hour anti-scam hotline as part of its comprehensive ScamShield Suite on September 27, 2024. From now on, residents can reach out for scam-related inquiries any time of the day or night, ensuring that help is always available when it's needed most.

The New ScamShield Hotline

Until now, the National Crime Prevention Council (NCPC) operated its anti-scam hotline from 9 am to 5 pm on weekdays. The newly rebranded ScamShield hotline, now accessible around the clock, has a new, simplified number: 1799, reduced from the previous 1-800-722-6688. Beyond offering reassurance and guidance for those uncertain about potential scams, the hotline also provides connections to seven major banks in Singapore—DBS/POSB, UOB, OCBC, Citibank, Maybank, Standard Chartered, and HSBC—allowing individuals to take swift action, such as freezing their accounts, if they believe they have fallen victim to fraud.

Introducing The ScamShield Website

To further enhance the availability of crucial information on scams, a new ScamShield website has been created. This portal consolidates vital anti-scam resources, making it easier for the public to access information regarding current scam trends, steps to take after being scammed, and preventive measures to avoid becoming a victim. The website features an online chat function, allowing users to interact directly with ScamShield helpline operators for real-time assistance.

Additionally, existing NCPC ScamAlert channels will be rebranded as ScamShield Alert. With over 35,000 subscribers on platforms like WhatsApp and Telegram, these channels will continue to provide timely updates on trending scams and helpful tips on protection strategies.

Growing Concerns Over Scam Incidents

Minister of Law and Home Affairs, K Shanmugam, addressed the shifting criminal landscape in Singapore during the launch event, noting a significant rise in cybercrime and scams while traditional physical crime remains low. Statistics reveal that in the first half of 2024 alone, the country witnessed 26,587 reported scam cases—a staggering 16.3% increase compared to the same period last year. This surge resulted in financial losses amounting to at least S$385.6 million (approximately US$295 million), marking a 24.6% rise.

Alarmingly, youths, young adults, and those under 50 represent 74.2% of scam victims. However, seniors suffer the highest average losses among age groups, indicating a pressing need for heightened awareness and protective measures tailored to vulnerable demographics. Additionally, a staggering 86% of reported scams involved self-authored transfers, often the result of elaborate deception techniques and social engineering.

Empowering the Public Against Scams

In light of these alarming statistics, Singapore’s authorities urge the community to arm themselves with the resources available in the ScamShield Suite. “Individuals must continue to play their part in strengthening their resilience against scams,” emphasized the SPF, NCPC, and OGP in a joint statement. They encourage everyone to actively engage with the hotline, website, and alert channels to safeguard themselves and their loved ones from the pervasive threat of scams.

Stay informed, stay vigilant—let's work together to beat the scammers at their own game!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)