Shocking Trade Move: Trump's Tariffs to Hit Close Ally Singapore!

2025-04-03

Author: Nur

In a bold attempt to reshape U.S. trade policy, President Donald Trump announced extensive tariffs on April 2, 2025, aiming to replace free trade with what he deems "fair trade." This sweeping measure includes a staggering 10% tariff on all goods entering the United States, a move that has particularly taken Singapore—one of America's closest allies—by surprise.

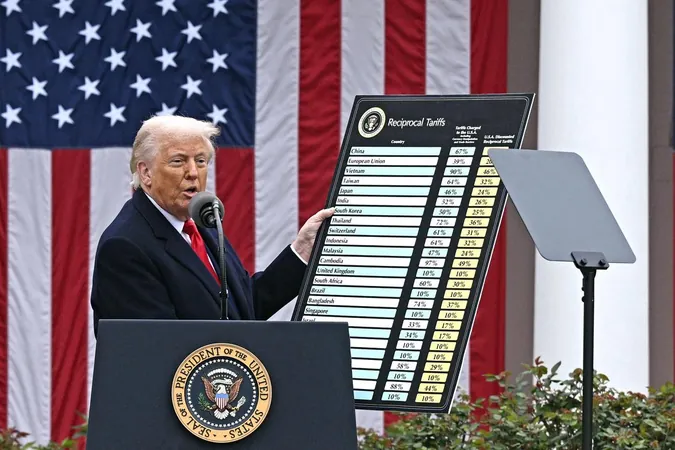

As part of his ambitious economic strategy, Trump has designated reciprocal tariffs that target at least 60 trading partners. He argues that these countries have imposed excessively high duties on American exports. The repercussions are most profound in the Asian markets, with Cambodia facing the sharpest increases at 49%. Highlights of the escalating tariffs include:

Highlights of Tariffs

China: 34% (on top of an existing 20%) Vietnam: 46% Thailand: 36% Indonesia and Taiwan: 32% each Malaysia: 24% Philippines: 17%.

Significantly, Canada and Mexico are exempt from these tariffs, while the European Union will face a 20% tariff, and Australia a 10% tariff. Wendy Cutler, a former U.S. deputy trade representative, found Singapore's inclusion in the tariffs particularly shocking, noting its status as a Free Trade Agreement partner with the U.S. since 2004, where it imposes no tariffs on American goods.

Under the current framework, Singapore applies a 9% goods and services tax applicable to imports, alongside excise taxes on specific items. Cutler remarked, “It’s bewildering that even U.S. FTA partners are now facing new tariffs, causing significant concern across the region.”

The broader implications are staggering. Trump's administration argues that these tariffs seek to eliminate an "unfair" trade imbalance. However, many experts suggest that these measures could incite a global trade war, raising fears of retaliatory actions from affected nations.

Trump declared, “April 2, 2025, will be remembered as the day American industry was reborn. Foreign nations will finally pay to access our market, the biggest in the world.” Despite his confidence, many economists warn that such tariffs could lead to inflation and potentially trigger a recession, drawing uncomfortable parallels to the 1930 Smoot-Hawley Tariff Act that exacerbated the Great Depression.

Furthermore, some analysts question the effectiveness of tariffs as a tool for revitalizing American manufacturing. Dr. Marcus Noland of the Peterson Institute for International Economics indicated that the proposed tariffs may not bolster manufacturing as intended but could instead lead to an increase in economic activities within the service sectors—such as real estate, retail, and hospitality—as resources shift away from manufacturing due to increased production costs.

Dr. Philip Luck, a former deputy chief economist at the State Department, cautioned that while manufacturing jobs might return, automation could limit job growth. "We might bring back a lot of manufacturing, but the jobs won’t follow," he said, highlighting the ongoing challenges posed by automation in the industry.

As these tariffs come into effect on April 5, analysts predict that the global trade landscape may face seismic shifts. With the U.S. economy at a crossroads, the world is watching to see how these bold moves will impact international relations, economies, and the future of global trade.

Stay tuned as we continue to uncover the fallout and responses from around the world!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)