Private Property Prices in 2025: MRT Accessibility and PSF Insights Unveiled!

2025-03-24

Author: Yu

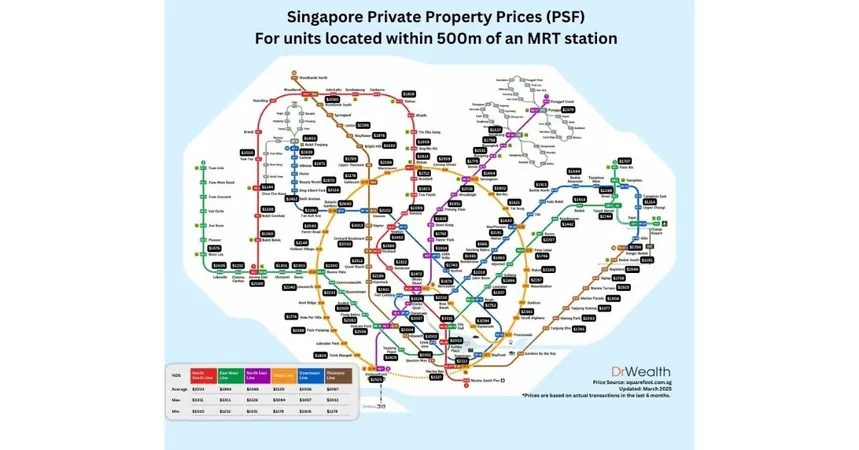

Considering the dynamic nature of Singapore's real estate scene, we’ve delved deep into the average price per square foot (PSF) for private properties—particularly condominiums and apartments—located within a 500-meter radius of major MRT stations for 2025.

A Detailed PSF Map: What You Need to Know

Our latest visualization integrates significant transaction data from the past six months, allowing prospective buyers and investors to gauge how property prices fluctuate across the island with respect to MRT accessibility. Given Singapore’s land constraints, where you choose to live is pivotal, but there's much more to consider.

Why Where You Live Is Only Part of the Equation

Proximity to MRT stations is undoubtedly a crucial factor affecting property prices. Areas easily accessible to public transport often see heightened demand, which naturally drives up prices. Yet, our findings reveal price variations between properties near different MRT stations that extend beyond mere location:

The Impact of New Launches on PSF Prices

Newly launched condominiums typically overshadow older resale options in pricing due to their modern amenities and fresh appeal. For instance, a brand-new condominium near a suburban MRT station might boast a higher PSF compared to an older unit located in central Singapore. Thus, while analyzing PSF data, be cautious about how new launches can distort averages.

Unique Features Enhancing Value

Not all properties are created alike. Factors that can significantly influence pricing include:

Tenure:

Freehold properties usually fetch higher premiums than 99-year leasehold counterparts, especially in well-established districts.

Facilities Available:

Condominiums with extensive amenities, like pools, gyms, and concierge services, tend to be priced at a premium.

Developer Reputation:

High-quality projects from renowned developers attract buyer interest and can enhance pricing.

Demystifying CCR, RCR, and OCR

Understanding Singapore’s property classifications is key to interpreting market trends:

Core Central Region (CCR):

Characterized by luxurious districts, the CCR includes areas like Orchard Road and Marina Bay, where properties command the highest PSF due to their prestigious status and limited inventory.

Rest of Central Region (RCR):

Encompassing city fringe areas like Queenstown and Bishan, the RCR represents a balanced choice for buyers looking for accessibility at a moderate price point.

Outside Central Region (OCR):

Generally more affordable, OCR includes suburban locales such as Punggol and Jurong, though popular new launches can still elevate prices here.

Key Takeaways on PSF Data Interpretation

While our PSF map provides a bird's eye view of the real estate landscape, careful analysis and context are essential in navigating this data. Here are essential considerations:

Mix of New and Resale Properties:

Areas with an influx of new launches might present artificially inflated PSF averages.

Variations Within the Same MRT Vicinity:

Comparing properties of different tiers (luxury versus mid-tier) located adjacent to the same MRT can result in diverging price points.

Lease Tenure Distinctions:

Freehold and leasehold units command different pricing, even in close proximity.

Market Dynamics:

Broader economic conditions, interest rates, and buyer sentiment all contribute to property valuations.

Conclusion: Smart Choices Start with Comprehensive Insight

While the map provides an initial snapshot of private property prices related to MRT stations, it serves best as a stepping stone for further exploration. Before making a property purchase—whether to live in or as an investment—consider the following:

Financial Capability and Budgeting:

Understand your financing options and how increasing interest rates may affect your purchasing power.

Long-term Growth Potential:

Research upcoming infrastructure projects and urban development plans that could enhance property value over time.

Evaluation of Unique Project Attributes:

Assessing the condo's amenities, layouts, and developer reputation can be as crucial as its location.

Alignment with Your Financial Strategy:

Ensure the prospective property fits seamlessly into your broader financial goals and portfolio.

Whether you're entering the market for the first time, upgrading your home, or exploring investment opportunities, informed decisions emerge from diligent research and strategic planning. Equip yourself with data, undertake comprehensive analyses, and aim for a match between your choices and your long-term aspirations!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)