OPPO Dominates Southeast Asia's Smartphone Market with 15% Growth in Q3 2024!

2024-11-11

Author: Daniel

Introduction

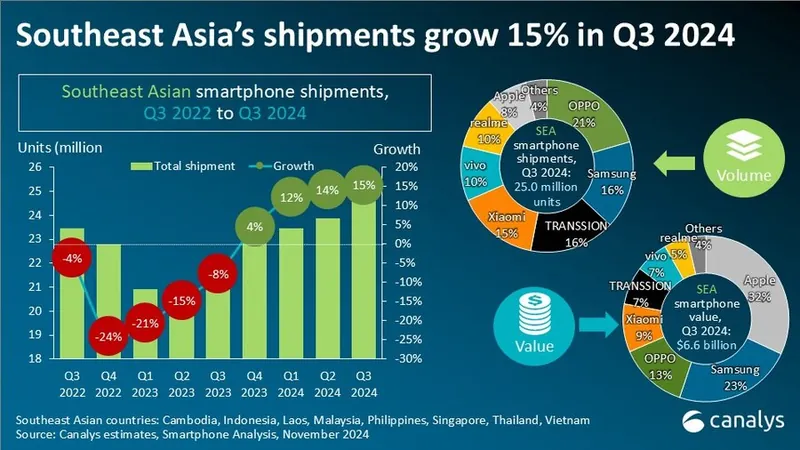

The latest research from Canalys indicates an impressive 15% year-on-year growth in Southeast Asia's smartphone market during Q3 2024, with a total of 25.0 million units shipped. Notably, OPPO has taken the lead for the first time, delivering 5.1 million units and capturing a 21% market share. This surge in sales can be attributed to the overwhelming success of its rebranded entry-level models such as the A3x and A3.

Market Rankings

Following closely behind, Samsung holds a 16% market share despite focusing on premium pricing strategies rather than sheer volume. Its emphasis on increasing Average Selling Price (ASP) is evident, highlighting a strategic pivot toward quality and value. Meanwhile, TRANSSION secured third place with 4.0 million units shipped (16% market share), but its rapid growth seems to be plateauing as it shifts its focus towards profitability over market share expansion.

Xiaomi landed in fourth place with a 15% market share and 3.9 million units shipped. The company benefited from a strong performance of competitively priced models like the Redmi 14C. Rounding out the top five, vivo shipped 2.6 million units, capturing a market share of 10%.

Price Dynamics and Competition

However, the rise in shipment volumes came with a 4% decline in the region's ASP. Analyst Sheng Win Chow explains that this decrease is largely due to a flurry of new launches that have oversaturated the low and mid-range price segments, resulting in intense competition among vendors. The relentless 'price war' has forced many companies to rely heavily on discounts and promotions, which is proving unsustainable as inflation and rising costs eat into profits.

Strategic Adjustments

Addressing these challenges, OPPO has streamlined its entry-level offerings, focusing on a single model to improve price competitiveness. Similarly, Samsung opted not to release a new variant of its lower-end A0s this year to maintain clarity in its product lineup.

5G Technology Landscape

The smartphone landscape in Vietnam is also evolving, particularly concerning 5G technology. The initial challenges of launching affordable 5G devices have positioned OPPO advantageously with its attractive 4G alternatives priced between $175 and $250. However, with government-backed initiatives to enhance 5G networks, the demand for affordable 5G phones is expected to rise, likely benefiting companies like Samsung that already have strong ties with telecom operators.

Future Outlook and Trends

As brands navigate this rapidly changing market, there is a growing need for differentiation through unique product offerings. Canalys predicts a future uptick in ASP despite the current decline as brands seek innovative ways to stand out. OPPO and Samsung are increasing investments in premium retail experiences to enhance brand perceptions and fulfill replacement demand.

Apple's Performance

Apple, too, is making noticeable strides, reporting a remarkable 34% growth in the region, aided by an aggressive expansion of its distribution channels. However, the market also poses unique challenges, as seen with Indonesia's recent restrictions on the iPhone 16 due to investment disputes.

Conclusion

In summary, Southeast Asia's smartphone market is poised for continued evolution as companies adapt to demographic shifts, competitive pressures, and technological advancements. With OPPO's current leadership and the accompanying shifts among other players, it's clear that the region remains a hotbed for innovation and opportunity in the smartphone industry. Stay tuned as we keep you informed on this dynamic landscape!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)