Nio Unveils New Share Offering at HK$29.46, Eyeing HK$4.03 Billion Boost for Future Innovations

2025-03-27

Author: Li

Nio Launches Expanded Share Offering

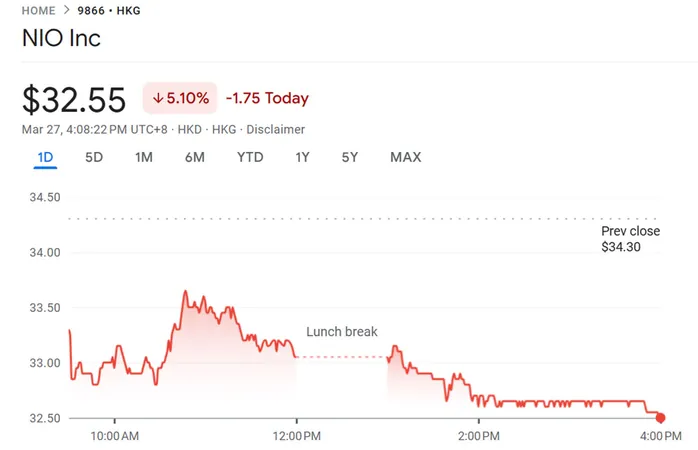

Nio Inc. has officially launched an expanded share offering, setting the price at HK$29.46 per share. This represents a 9.49% discount compared to its closing price of HK$32.55 in Hong Kong on Thursday. The estimated total from this latest offering is a substantial HK$4.03 billion.

Details of the Offering

The electric vehicle (EV) manufacturer aims to complete this placement approximately by April 7, pending customary closing conditions. Nio originally sought to issue up to 118,793,300 shares but has now increased that number to 136,800,000, a move likely aimed at bolstering its financial position amid recent challenges.

Banking Partners

Prominent banking institutions, including Morgan Stanley Asia Limited, UBS AG Hong Kong Branch, China International Capital Corporation Hong Kong Securities Limited, and Deutsche Bank AG, have been designated as placing agents for the offering.

Use of Proceeds

The proceeds from this offering are intended for crucial investments in research and development of innovative EV technologies, expansion of new product lines, and strengthening the company's financial reserves.

Current Challenges

Recently, Nio has been grappling with disappointing delivery numbers, particularly related to its L60 SUV, which has fallen short of expectations since its release under the Onvo sub-brand. This lack of momentum in vehicle sales has raised alarms about the company’s financial health, which has been laid bare in its fourth-quarter report disclosed on March 21.

Financial Standing

As of December 31, 2024, Nio reported that its current liabilities surpassed its current assets. However, it has emphasized that it possesses sufficient financial resources to sustain operations for at least the next year. This new capital raise could provide essential support as the company seeks to navigate a challenging marketplace.

Targeted Investors

The latest offering has been specifically targeted at non-U.S. investors, in compliance with Regulation S under the Securities Act of 1933. Nio's management reassures stakeholders that the funds will be allocated meticulously to foster growth and innovation in the competitive global EV landscape.

Conclusion

This strategic maneuver is a part of Nio's broader vision to assert its position within the burgeoning electric vehicle sector and meet the increasing demand for advanced, sustainable transportation solutions. Stay tuned as Nio aims to turn the tide and re-engage a market eager for innovative electric vehicles!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)