Nio Reports 20,976 Vehicle Deliveries in October: What This Means for the EV Market!

2024-11-01

Author: Jia

Nio's October Performance

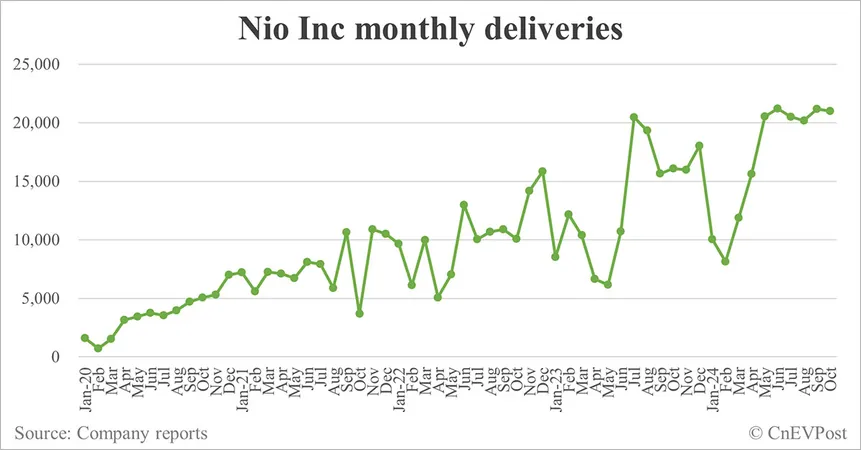

In a recent report, Nio Inc. announced impressive figures for October as it delivered a total of 20,976 vehicles, maintaining a strong performance with six consecutive months exceeding the 20,000 unit mark. However, the company's flagship brand, Nio, experienced a decline in deliveries while its sub-brand, Onvo, saw an extraordinary surge.

Brand Deliveries Breakdown

Nio's main brand delivered 16,657 vehicles in October, reflecting a decrease of 18.14% compared to September's figures. In contrast, Onvo recorded a staggering 4,319 deliveries, marking an incredible increase of 419.11% from the previous month.

Year-Over-Year Growth

Despite the fluctuations within the individual brands, the overall performance showcased a year-over-year growth of 30.50%, up from 16,074 units delivered in October last year. However, Nio's total was slightly down by 0.97% from the 21,181 vehicles delivered in September.

Total Deliveries in 2023

Throughout the first ten months of 2023, Nio has delivered a total of 170,257 vehicles, reflecting a robust year-on-year growth of 35.05%. The main Nio brand contributed 165,106 units, a 30.97% increase from the same period last year.

Cumulative Deliveries and Onvo's Launch

Since its inception, Nio has reached a cumulative total of 619,851 vehicles delivered, with the Nio brand accounting for 614,700 units and Onvo contributing 5,151 units since its launch at the end of September. Notably, Onvo's first model, the L60 SUV, was launched on September 19, and has been creating considerable buzz in the market.

Pricing Competitive Edge

This model starts at RMB 206,900 ($29,040), undercutting the Tesla Model Y, which currently starts at RMB 249,900 in China. Under Nio's innovative Battery as a Service (BaaS) program, the starting price drops to RMB 149,900, with monthly rental fees varying based on battery capacity.

Target Market Segmentation

The Onvo brand strategically targets the mid-range price segment of RMB 200,000 to RMB 300,000, while Nio positions itself within the premium segment of RMB 300,000 to RMB 600,000. This approach allows Nio to cater to a broader audience in the competitive EV landscape.

Production Capacity and Future Plans

Nio's capabilities are further enhanced by its production capacity. CEO William Li revealed that Onvo's production capacity is projected to reach 5,000 units in October and expand to 20,000 units by March 2025. The company currently operates two assembly plants in Hefei, Anhui province, capable of producing 10,000 units for the Nio brand and 20,000 for Onvo monthly.

Expansion of Services

To support its growing user base and increase engagement, Onvo plans to expand its network of sales, service, and battery swap stations, already operating 166 Onvo Centers in 60 cities. Furthermore, Nio aims to have 1,000 battery swap stations operational for Onvo by the end of the year, supplementing its existing 2,625 swap stations across China.

Conclusion: Nio's Resilience in the EV Market

As the EV market experiences rapid growth and competition intensifies, Nio's recent performance highlights its resilience and strategic positioning. With a focus on innovative services and expanded accessibility, the company is poised for sustained growth in the coming months. Stay tuned as the world of electric vehicles evolves!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)