Navigating Low Interest Rates: Smart Investment Alternatives to T-Bills and Fixed Deposits

2025-03-28

Author: Arjun

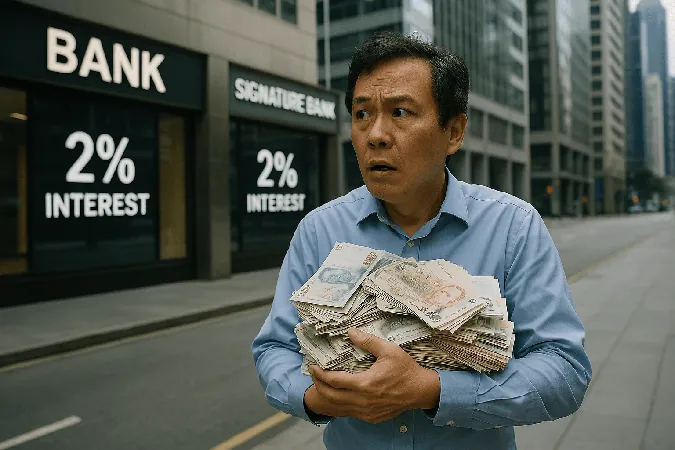

For a long time, investing was relatively straightforward. The smart move was simply to deposit your cash in fixed deposits or purchase T-bills, basking in yields of nearly 4% without the associated risks.

However, the landscape has changed dramatically. With interest rates now dipping below 3% and predictions of further cuts from global central banks to stimulate faltering economies, investors are left feeling apprehensive. The US Federal Reserve is anticipated to reduce rates three times this year, leading to a current 6-month Singapore T-bill cut-off yield of just 2.73%. If you're seeking better returns, it’s essential to broaden your horizons.

1. Cash Management Accounts

For those keen on retaining some semblance of yield above 3%, cash management accounts are a viable option. Emerging robo-advisors and digital banking platforms are keen to draw in new deposits and are offering diversified rates varying from 2.5% to as high as 3.8%.

Examples include: - **Endowus:** 2.7% to 3.8% - **StashAway:** 2.5% to 3.6% - **Maribank:** 3.26% - **Syfe:** 2.3% to 3.2% - **Chocolate Finance:** 3.3%

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)