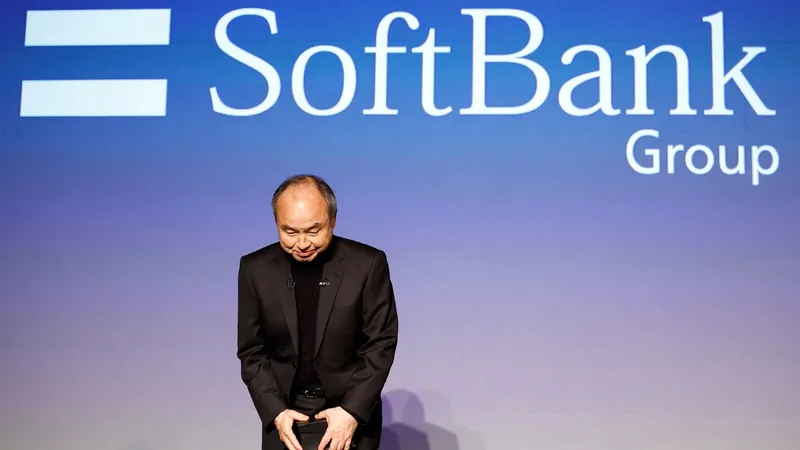

Masayoshi Son's High-Stakes AI Gamble: Is SoftBank's Future in Jeopardy?

2025-04-20

Author: Siti

In a bold move that has the investment world buzzing, SoftBank's founder Masayoshi Son is doubling down on artificial intelligence, declaring OpenAI his closest ally in the race toward Artificial General Intelligence (AGI) — a landmark achievement that could reshape technology as we know it.

OpenAI, a trailblazer in AI development, recently celebrated surpassing a staggering 1 billion weekly active users with its cutting-edge AI tools. This monumental milestone has cemented Son's reputation as one of the most audacious investors in the tech sector, even as he navigates through a rocky few years marked by significant losses.

Just two years ago, SoftBank recorded a shocking $6.2 billion loss due to its investments in ventures like WeWork, coupled with a broader tech sell-off that was influenced by rising interest rates and inflation. Despite a recent rebound with a reported net profit of ¥636.2 billion for the nine months ending December 2024, the company’s fortunes took a hit in the last quarter.

Beyond OpenAI: Expanding the AI Empire

Son's ambitions extend far beyond OpenAI. Under its "Cluster of No.1 AI Strategy," SoftBank is aggressively investing in leading AI companies across various sectors, including chip design and autonomous technology. Recent acquisitions include a $6.5 billion deal for Ampere Computing to bolster its infrastructure and backing Wayve, a UK-based self-driving car startup.

In addition to these ventures, SoftBank is spearheading the $500 billion Stargate project—an ambitious data center initiative set to revolutionize processing capabilities. The company is also collaborating with OpenAI in a 50-50 joint venture named Cristal Intelligence, focusing on developing advanced AI solutions for enterprises in Japan.

Funded by Debt: Risk or Strategy?

While SoftBank boasts around ¥5 trillion ($31 billion) in cash reserves, much of its forthcoming AI investments are set to be financed through substantial borrowing. Historical trends show that SoftBank has frequently capitalized on debt to fuel its acquisitions.

Recently disclosed reports indicate that the initial $10 billion investment in OpenAI will be sourced from loans, including those from Mizuho Bank. SoftBank also aims to secure $16.5 billion in loans for the Stargate project. Additionally, the company plans to raise over $4 billion in retail bonds—sparking concerns among creditors.

Investor Concerns: Is a Bubble Brewing?

As Masayoshi Son, often dubbed the "Gambling Man" in his biography by former Financial Times editor Lionel Barber, stakes his reputation on AI, investor apprehension is palpable. With 44% of U.S. venture capital investments funneled into AI start-ups in 2024—up from just 15% in 2020—concerns arise that the market could be overhyped.

Goldman Sachs analysts have cautioned that the billions poured into AI companies might not yield the expected returns. In early 2024, a report highlighted that while the industry spent an astonishing $50 billion on Nvidia chips, it only generated $3 billion in revenue, leaving room for doubt about the sustainability of these aggressive investments.

With the landscape of AI rapidly evolving, the question remains: will SoftBank’s audacious gambles pay off, or are we on the brink of witnessing a major bubble burst in the tech investment arena?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)