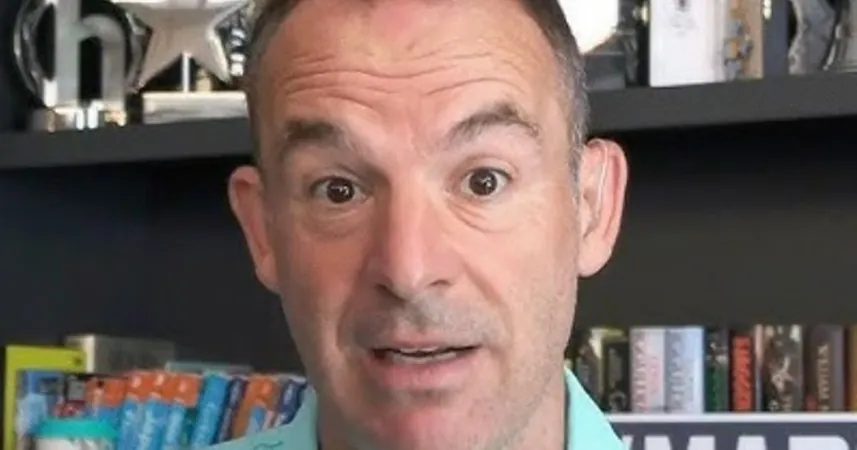

Martin Lewis Reveals the Best Banks to Boost Your Savings Before Interest Rates Fall

2024-09-30

In a recent announcement, finance expert Martin Lewis urged consumers to explore their banking options if they want to maximize their savings in light of anticipated interest rate cuts. Speaking on BBC Sounds and ITV, Lewis highlighted the often-overlooked flexibility of easy-access savings rates across the UK.

He noted on Twitter that many easy-access savings accounts have begun to outperform fixed-rate accounts, emphasizing, "The top easy access savings now beat fixes. Check what yours pay; you can still get 5% or more."

In his popular weekly newsletter, Lewis explained the current financial landscape, stating, "What's happening to savings is akin to what's happening with mortgages: higher rates equate to benefits now, whereas lower rates imply disadvantages." He explained that fixed-rate offers have recently decreased because they rely on long-term interest rate projections, while top-performing easy-access rates are connected to the UK base rate, which the Bank of England recently held steady.

Although typically, consumers are rewarded for locking their funds into a fixed account, the current market suggests that easy-access rates may remain competitive even as the forecast points to a base rate cut in November. Despite a potential reduction of 0.25 percentage points, Lewis suggested that the highest easy-access accounts will still be on par with current fixed options. This situation presents a favorable opportunity for those wanting to retain accessibility to their funds.

Lewis cautioned that, while locking in rates offers security against future drops, now might be the wisest time to switch if you find a better option. "For everyone, the key rule is that there are massive variances between the top-tier and average rates in each category, so it's crucial to check what you’re earning and switch if necessary," he advised.

In his analysis, Lewis highlighted several top-performing banks and their offerings: Chip leads with a competitive rate of 5%, followed by Oxbury at 4.87%, OakNorth Bank at 4.82%, and Monument at 4.81%. Notably, Chip's account can be opened through an app with no minimum deposit, whereas Oxbury requires a minimum of £25,000 and accepts up to £500,000 online. OakNorth Bank sets its minimum requirement at £20,000, and Monument starts at £25,000.

Lewis further stressed that there are more options available, especially if customers have or are willing to set up the right current account, which can lead to even higher savings rates.

As we face the possibility of changing interest rates, now is the time to reassess your savings strategy. Don't miss out on the opportunity to make the most of your hard-earned money!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)