Is the 2025 Tornado Season About to Wreak Havoc on Catastrophe Bonds? Investors Brace for Impact!

2025-03-17

Author: Siti

As severe weather sweeps across the United States, with significant tornado activity reported over the weekend in the Midwest and Southern states, Icosa Investments has issued a stark warning to investors regarding the implications for aggregate catastrophe bonds. The recent weather events serve as a timely reminder of the looming dangers associated with tornado season.

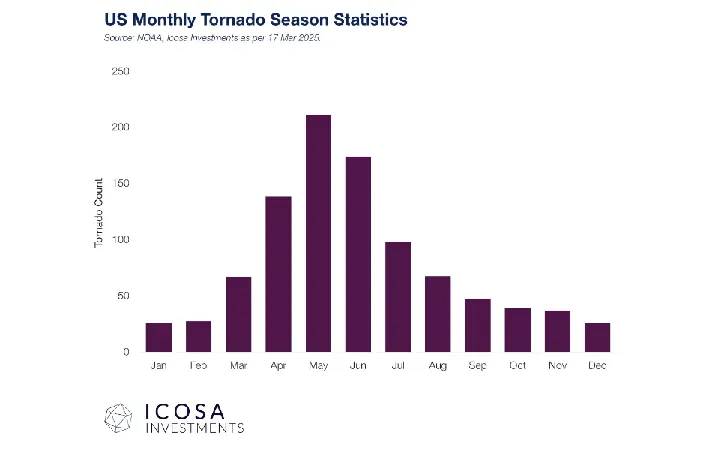

Icosa Investments, a well-respected fund manager specializing in catastrophe bonds, cautions that a number of these bonds have already seen their annual deductibles substantially eroded due to previous disasters. Tornado season typically peaks during the spring months, meaning investors should be prepared for an increase in tornado-related threats in the coming weeks.

While individual tornadoes might not typically cause catastrophic financial losses—generally not exceeding a few billion dollars—Icosa Investments points out that the real risk arises from cumulative losses over time. Aggregate catastrophe bonds are designed to cover multiple events within a specific risk period, making them particularly vulnerable during high-activity seasons like spring.

This year is poised to be especially precarious for investors in these securities. Many aggregate indemnity transactions have already suffered from earlier losses caused by last year’s hurricanes—namely Hurricanes Helene and Milton—and the devastating California wildfires. These catastrophic events have severely depleted the buffers that were previously in place to absorb new tornado-related losses.

Florian Steiger, CEO of Icosa Investments, warns that if tornado activity in 2025 mirrors that of the previous year, the market could witness multiple defaults in cat bonds over the coming months. Such defaults could shake investor confidence and destabilize the already struggling catastrophe bond market.

The erosion of annual deductibles for aggregate cat bonds is notable, with several bonds marked down sharply in secondary pricing sheets due to recent disasters. While it would typically require a significant tornado outbreak or severe convective storm to further erode these values, the impending peak of tornado season combined with lower deductible buffers could spell trouble.

With the threat of severe thunderstorms being a covered peril for many aggregate cat bonds, the current heightened risk underscores the need for caution. Icosa Investments recently suggested that while the current secondary prices may reflect some of this risk, certain aggregate indemnity cat bonds might still be overpriced. Investors are encouraged to carefully evaluate these securities in light of the evolving risk landscape.

As the 2025 tornado season approaches, the stakes are high and the investment landscape is fraught with uncertainty. Will catastrophe bonds withstand this tumultuous period, or are we on the brink of a financial storm of a different kind? Investors, take heed!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)