Hongkong Land Shifts Gears: A Bold New Strategy Focusing on Capital Recycling

2024-10-29

Author: Daniel

Hongkong Land Shifts Gears: A Bold New Strategy Focusing on Capital Recycling

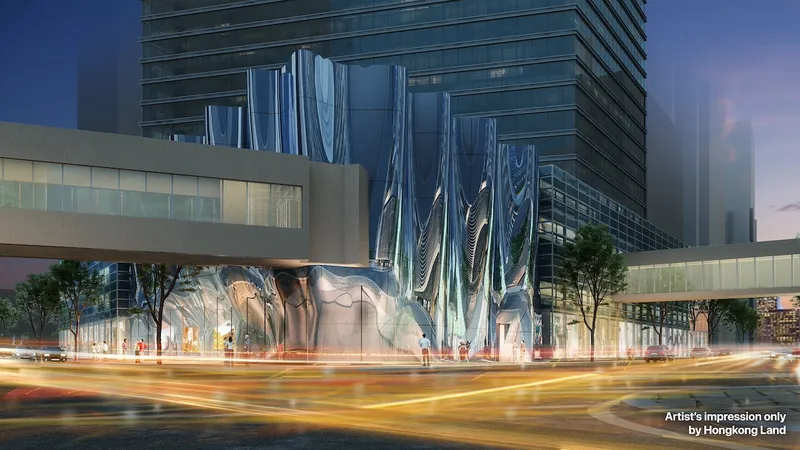

In a game-changing announcement on October 29, Hongkong Land revealed its new strategic direction. The renowned property group will pivot away from its traditional build-to-sell investments throughout Asia, opting instead to recycle capital from completed projects into promising integrated commercial property ventures.

This innovative approach is designed to enhance Hongkong Land's core competencies, generate sustainable long-term income, and ultimately provide superior returns for its shareholders. The decision is unveiled just months after the appointment of Michael Smith as CEO on April 1, following an exhaustive six-month review of the company’s operation strategies.

Key Elements of the New Strategy

Key elements of the freshly minted strategy include a targeted expansion of their investment properties in major Asian gateway cities. Hongkong Land aims to develop, own, or manage ultra-premium mixed-use projects specifically tailored to attract multinational corporations and financial services firms. This shift represents not just a reinvestment in property but an evolution of the urban landscape, redefining modern workspaces.

Strategic Partnerships and Collaborations

Moreover, the company plans to fortify its strategic partnerships, particularly with the prestigious Mandarin Oriental Hotel Group. By leveraging collaborations with over 2,500 tenants, including global leaders in luxury goods and finance, Hongkong Land is set to create dynamic environments that cater to the modern consumer.

Vision for the Future

Michael Smith expressed a vision rooted in Hongkong Land’s 135 years of heritage, stating, “Our ambition is to lead the way in crafting experience-driven city centers that redefine lifestyle and work-life balance in key Asian cities.” His commitment to deepening partnerships and honing competitive strengths is expected to usher in robust growth and long-lasting value creation.

Market Reaction

However, despite these promising changes, shares of Hongkong Land recorded a slight decline, closing at $3.89, marking a drop of 1.52% on the day of the announcement.

Conclusion

This strategic shift highlights Hongkong Land's proactive response to evolving market demands, ensuring it stays at the forefront of commercial property evolution in Asia. Will this new focus turn the tide for the company's performance? Only time will tell, but investors and analysts alike will be watching closely.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)