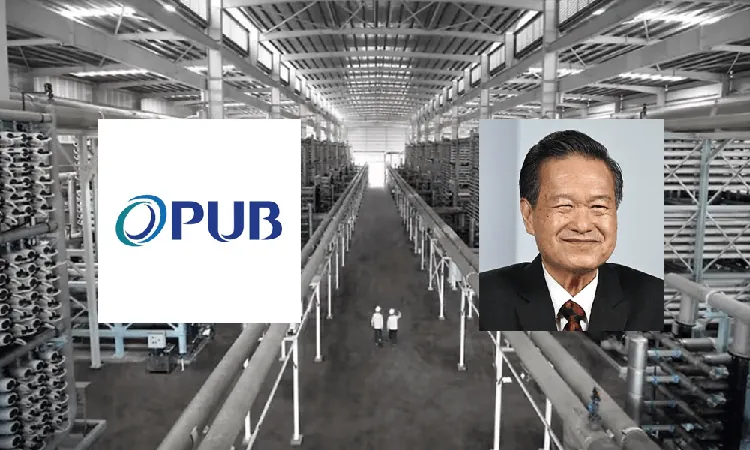

Controversy Erupts as PUB Challenges Tan Kin Lian's Claims on Tuaspring Takeover!

2024-09-30

Introduction

In a recent showdown over social media, the Public Utilities Board (PUB) has officially refuted claims made by former NTUC CEO and presidential candidate Tan Kin Lian about the acquisition of the Tuaspring Desalination Plant, a contentious topic that has raised eyebrows across Singapore.

The Claims Made by Tan Kin Lian

On September 28, 2023, Tan posted on Facebook that PUB had taken control of the Tuaspring Desalination Plant “for free,” implying a detriment to Hyflux’s investors and bondholders. His assertion claimed that this decision came without compensation, igniting a firestorm of debate online. However, in a timely correction issued on September 29, PUB clarified the facts regarding this high-stakes takeover.

PUB's Response

PUB strongly contested Tan's portrayal of the acquisition, emphasizing that the plant—a previous asset of the beleaguered Hyflux—was not simply acquired without cost. In fact, an independent valuation revealed that the Tuaspring plant had a negative value, meaning PUB would need to pay for the costly upkeep instead of acquiring it at a profit. This information was originally divulged in Parliament by then-Minister for the Environment and Water Resources, Masagos Zulkifli, in April 2019, where it was confirmed that operational costs were far greater than the plant’s worth.

Impact on Investors

Amidst the backdrop of Hyflux's precarious financial situation, PUB opted to waive a sum owed by the company’s subsidiary, Tuaspring Pte Ltd (TPL). This measure was positioned as necessary to ensure Singapore's water security, but it also meant that approximately 34,000 bondholders owed nearly $900 million were left with substantial losses—a reality that many retail investors find hard to swallow.

Geographical Misrepresentation

While PUB's statement outlined factual inaccuracies in Tan’s comments, the implications of the takeover undeniably resonate with those who invested in Hyflux. The plant was indeed taken over without a direct financial transaction—PUB's decision to forgo compensation has left many questioning the financial ramifications for Hyflux's creditors and whether adequate measures were taken to compensate them.

Clarification on Facilities

Moreover, Tan's assertions did not simply highlight financial mishaps but also misrepresented the geographical relationship between Tuaspring and the NEWater Factory, mistakenly stating they were co-located. PUB clarified that the two facilities are, in fact, situated six kilometers apart, each serving different purposes in Singapore’s water management strategy.

Investor Frustration

As the controversy unfolds, it reveals a deeper frustration among Hyflux’s investors, many of whom have suffered significant losses due to the company's financial missteps and resultant collapse. The issue remains whether PUB's approach could have been more accommodating toward these investors, or if the necessity of public interest in water security justified the measures taken.

Lingering Questions

While the agency has sought to ensure accurate discourse, lingering questions about its responsibility for managing the fallout from Hyflux's failure persist. Also, as of the morning following PUB's statement, Tan had yet to update his post, reflecting a possibility of ongoing tension in public opinion.

Historical Context

Hyflux, once hailed as a formidable water technology firm, became a cautionary tale of financial management and corporate downfall, culminating in the takeover of the Tuaspring facility, which was initially developed at a staggering cost of S$1.05 billion.

Broader Implications

In a separate yet equally pressing topic, the international community continues to spotlight the escalating humanitarian disaster in Gaza, with calls for urgent action echoing through various forums, highlighting the complex interplay of political, social, and economic crises affecting global citizens.

Conclusion

As Singapore navigates its local issues while keeping an eye on broader international affairs, the PAO's recent corrections serve as a reminder of the critical balance between public interest, corporate responsibility, and the well-being of its investors. Let's keep our eyes peeled—this is a story that could have implications far beyond our shores!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)