China's Loan Subsidy Sparks Debate as Youth Debt Crisis Looms

2025-09-12

Author: John Tan

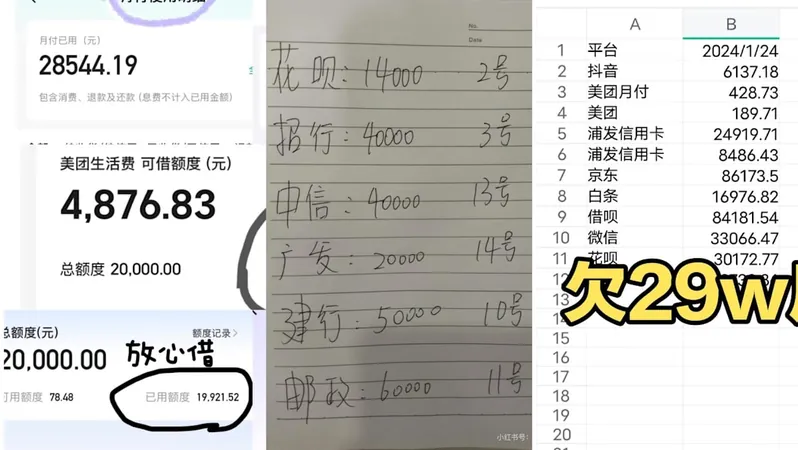

In a bold move, China has unveiled a new loan subsidy program that aims to alleviate financial burdens on consumers while stimulating the economy. However, experts are skeptical about its effectiveness, especially among the younger population who are drowning in debt.

The subsidy structure draws a line between borrowing amounts, with incentives differentiating loans above and below 50,000 yuan. This segmentation seems designed to drive sales of big-ticket items, notably cars. While shoppers can enjoy up to 3,000 yuan in interest subsidies from lenders, those opting for smaller loans will find their benefits limited to just 1,000 yuan.

Cai from Southwest University of Finance and Economics (SWUFE) indicates that while the initiative aims to make cars more accessible, the actual financial relief it offers may fall short, particularly for those eyeing premium vehicles. He notes that past programs, such as the trade-in subsidies for new energy vehicles, initially sparked interest but eventually led to a decline in sales growth.

Recent statistics reveal that the boom in new energy vehicle (NEV) sales has waned dramatically, plummeting from a staggering 87% growth rate at the year's outset to just 27.4% by July. Major player BYD reported stagnant year-on-year sales in August at 373,600 units, a clear signal that subsidies alone can't maintain industry momentum.

Cai estimates that this new subsidy initiative might only boost NEV sales by 5 to 8 percentage points, marginally affecting overall retail growth. He asserts that for a tangible impact, this policy must be coupled with additional measures—such as manufacturer discounts, enhanced charging infrastructure, and supportive vehicle registration policies.

David Zhang, secretary-general of the International Intelligent Vehicle Engineering Association, offered a more optimistic view. He believes that this subsidy will alleviate debt burdens for households, facilitate bank operations, and support manufacturers—ultimately benefiting the economy.

Alongside personal loans, Beijing has introduced a separate subsidy scheme targeted at service-sector enterprises across eight key areas, including healthcare and tourism. This initiative allows companies to borrow up to 1 million yuan with an interest subsidy cap set at 10,000 yuan.

Officials tout this dual approach as a strategy to lower financing costs and stimulate job creation within labor-intensive industries. Wang Bo, from the Ministry of Commerce, explains that the policy addresses both consumer demand and service supply. The end goal is to amplify household consumption and enhance service quality, particularly in sectors that directly impact daily life, such as healthcare and childcare.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)