China's Gold Consumption Takes a Hit: Down 6% Amid Price Surge

2025-04-28

Author: Sarah

China's Gold Consumption Dips Significantly

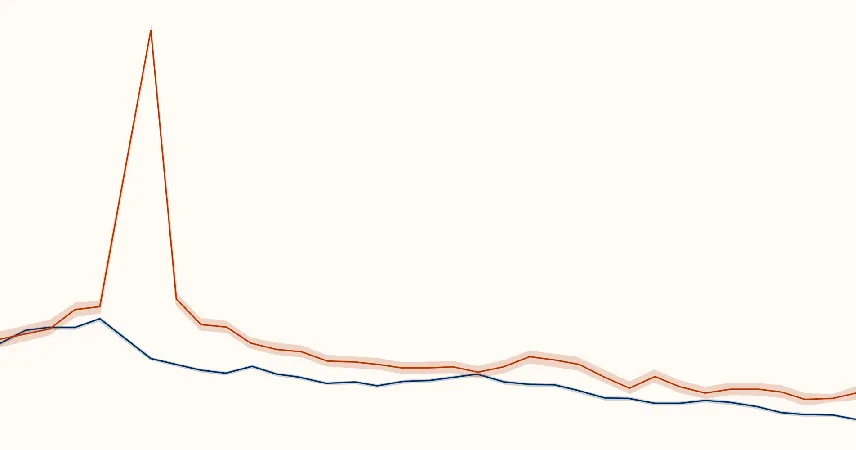

In a surprising turn of events, China's gold consumption fell by nearly 6% in the first quarter of 2025, totaling 290.492 metric tons. This decline, reported by the China Gold Association, is primarily attributed to soaring gold prices that are putting a damper on the appetite for traditional gold jewellery.

Shift in Consumer Trends

As the cost of gold continues to rise, consumers are rethinking their purchases. Once favored gold ornaments and jewellery have taken a backseat, making way for investment-centric gold bars and coins. This trend marks a significant shift in consumer behavior, driven by a growing preference for safe-haven assets amidst ongoing geopolitical tensions and economic uncertainty.

Jewellery Sales Plummet

The impact of high prices is most evident in the jewellery sector, where sales plummeted by a staggering 26.85%, amounting to just 134.531 tons in the first quarter. This steep decline underscores how consumers are prioritizing investment over ornamental purchases.

Gold Bars and Coins Experience a Surge

Contrastingly, the demand for gold bars and coins skyrocketed, soaring by 29.81% to reach 138.018 tons. Investors are clearly turning to these forms of gold as a shield against uncertain economic conditions.

Domestic Gold Production Holds Steady

On the production side, China's domestic gold output showed resilience, increasing by 1.49% year-on-year to 87.243 tons in Q1 2025. When incorporating gold produced from imported materials, which amounted to 53.587 tons, the nation’s total gold output reached an impressive 140.830 tons, up 1.18% from the previous year.

The Future of Gold Consumption in China

As market dynamics continue to evolve, all eyes will be on how China's gold consumption adapts in the coming quarters. Will consumers revert to jewellery purchases if prices stabilize, or is this a permanent shift in investment strategy?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)