China's Electric Vehicle Market Update: The Latest Insurance Registrations Show Surprising Trends!

2024-09-24

Major Players' Performance

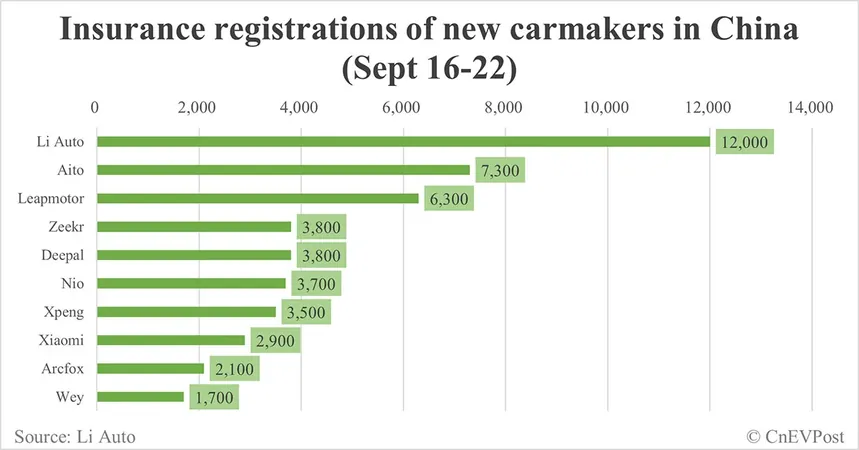

Nio recorded 3,700 insurance registrations last week, marking an 11.9% decrease from 4,200 the previous week. Despite this dip, Nio has been witnessing steady growth overall, having delivered 20,176 vehicles in August — its fourth consecutive month above 20,000 units. Year-to-date, Nio has achieved 128,100 vehicle deliveries, a healthy increase of 35.77% compared to 2022. The company expects to deliver between 61,000 to 63,000 vehicles in the third quarter, underscoring its commitment to growth.

Tesla continues to be a significant player, with 13,800 insurance registrations in the past week, down 11.54% from 15,600. The company celebrated record sales in August, delivering 86,697 vehicles, which included a robust 23,241 units for export. Despite a slight year-on-year decrease of 0.57% in total sales from January to August, Tesla's Shanghai factory maintains its status as a crucial hub for both local and global deliveries.

BYD tops the list with an impressive 80,600 insurance registrations, although this reflects a 6.28% decline from the 86,000 recorded in the prior week. The company has shattered records with 373,083 NEV sales in August, a 35.97% year-on-year growth. With ongoing technological advancements and new model launches, BYD stands poised for continued success in the electric vehicle segment.

Li Auto reported 12,000 insurance registrations, a modest drop of 4.76% from the previous week. In August, the company saw 48,122 deliveries, indicating a remarkable 37.83% increase from the previous year. With a strong sales trajectory and a forecast of 145,000 to 155,000 units for the third quarter, Li Auto is undeniably on an upward path.

Xiaomi, a newcomer to the EV market, saw 2,900 insurance registrations, reflecting a 6.45% decrease. The company’s SU7 model has received a warm reception, reportedly delivering over 10,000 units in August, just shy of more detailed metrics.

Xpeng faced an 18.6% drop in insurance registrations, totaling 3,500 for the week. However, the company still achieved an impressive 14,036 vehicle deliveries in August, showcasing a consistent upward trajectory with a 26% increase from July.

Zeekr, another emerging player, reported 3,800 registrations, a 19.15% decrease from the prior week. Even so, the company delivered 18,015 vehicles in August, bolstered by a staggering 46.43% rise year-on-year.

Competitive Landscape and Trends

The overall trend for EV insurance registrations suggests a dip across several brands, signaling potential market adjustments or consumer sentiment shifts. The factors contributing to this could range from economic fluctuations, evolving consumer preferences, and intensified competition among brands to capture market share.

As the landscape continues to evolve, the launch of new models, advancements in technology, and strategic initiatives will be vital for these companies to maintain their positions. With increasing infrastructure for electric mobility, the future of China’s electric vehicle market looks promising yet increasingly competitive.

The Road Ahead

The third quarter will be crucial for all the major players as they look to meet their projected delivery numbers. The performances of these brands, alongside their innovative strategies, will be vital indicators of who will thrive in this ever-expanding market.

Stay tuned for more updates on the electric vehicle revolution in China! 🚗💨

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)