Breaking News: Fed's Game-Changing Rate Cut Paves the Way for Job Growth!

2025-09-17

Author: Sarah

Historic Shift: From Combatting Inflation to Boosting Employment

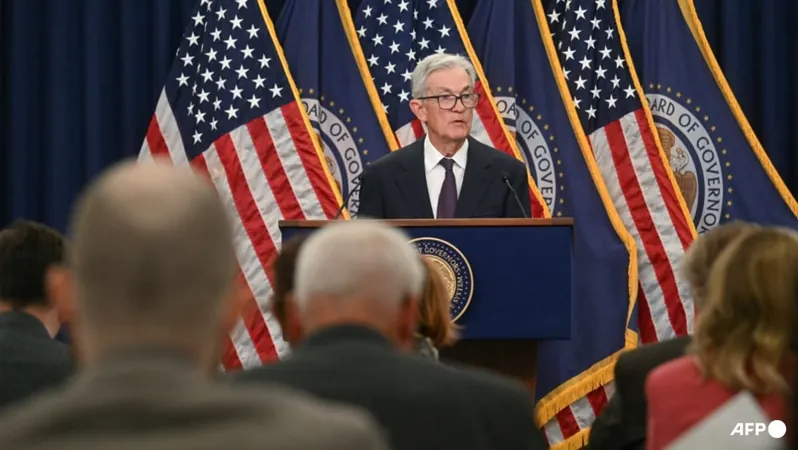

In a bold move that has sent ripples through the financial world, the US Federal Reserve announced a much-anticipated interest rate cut of 25 basis points on September 17th. This shift marks a significant pivot in the Fed's priorities, highlighting an urgent focus on job growth rather than inflation control.

Fed Chair Jerome Powell emphasized the decision during a press conference following the central bank's two-day meeting, stating, "It’s really the risks that we’re seeing to the labor market that were the focus of today’s decision." His remarks underline a growing recognition of the economic challenges facing American workers.

Lowest Rates Since 2022: What It Means for You

With the new rate set between 4 percent and 4.25 percent, we are now witnessing the lowest interest levels since late 2022. This opens the door for consumers and businesses alike to consider new loans and investments, potentially stimulating a much-needed boost in economic activity.

Future Projections: More Cuts on the Horizon?

According to projections released by Fed officials, the central bank anticipates further rate reductions—expectations are set for two more cuts this year and one in 2026. Will these moves help stabilize the job market? Many are hopeful, as the Fed navigates turbulent economic waters, aiming to create sustainable job growth.

Stay tuned for live updates as we cover this developing story and its impact on the economy!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)