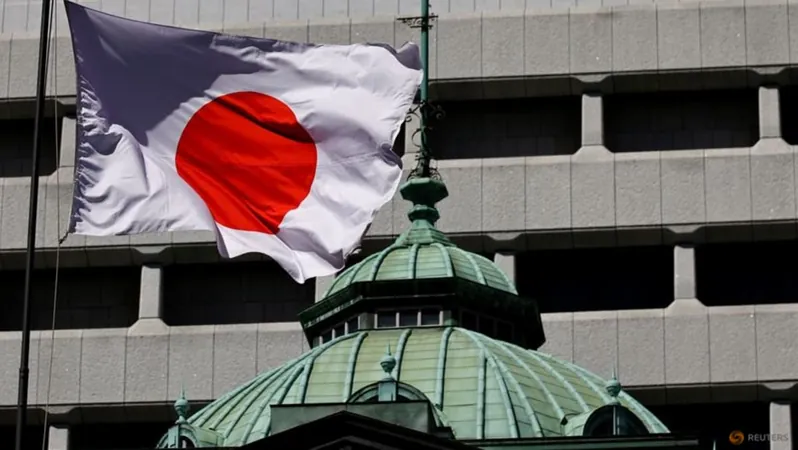

BOJ Policymakers Split Over Rate Hike Timing as U.S. Elections Approach

2024-11-11

Author: Rajesh

TOKYO – As the U.S. presidential election looms just days away, Bank of Japan (BOJ) policymakers find themselves sharply divided regarding the timing of potential interest rate hikes. A recently released summary from their October meeting highlights concerns about impending market volatility influenced by election outcomes.

In their discussions held towards the end of October, BOJ board members underscored the critical need to monitor the economic repercussions arising from market fluctuations, which remain pivotal in determining when the central bank might next increase interest rates. Many officials conveyed that rates would likely stay low in the short term, but addressed the necessity of being cautious given the potential for unrest in global markets.

One board member expressed foreboding about the dangers of increased volatility following the U.S. election, emphasizing, "The BOJ must be well prepared for heightened market instability, especially with speculation surrounding the election results." This sentiment indicates a recognition that external factors, particularly developments in the U.S., will significantly impact economic conditions in Japan.

While fears of a hard landing in the U.S. economy have eased, officials maintained that it was premature to assume market tranquility would return. They cautioned that reactions to election results could incite a fresh wave of volatility, which could, in turn, influence Japan’s monetary policy decisions.

During the October 30-31 meeting, the BOJ opted to sustain its ultra-low interest rates, but the dialogue hinted that a gradual transition towards rate hikes may be on the horizon if economic and inflationary conditions improve. If former President Donald Trump prevails once again, his administration's stance on trade and tariffs could stoke inflation concerns and complicate the U.S. Federal Reserve's policy trajectory, thereby reverberating across global markets.

Meanwhile, internal divisions among the BOJ board about how to communicate the bank's future path have surfaced. Some members advocate for a gradual approach to rate increases, favoring a careful assessment of economic conditions before proceeding, especially given the ongoing challenges posed by rising import prices due to a weak yen.

Japanese households and small businesses, particularly sensitive to the repercussions of imported inflation, have expressed support for stabilizing the currency—a situation exacerbated by a yen that has recently hovered around 153.17 per dollar. This volatility has inflicted a toll on consumer sentiment amidst rising costs for essential goods.

Kazuo Ueda, the BOJ governor, highlighted that inflation risks linked to the weak yen played a significant role in the central bank’s decision to raise rates to 0.25% in July, noting that the shift aimed not only to rein in inflation but also to maintain the financial system's integrity amid shifting global dynamics.

Despite the current climate, a recent Reuters poll indicated a slim majority of economists believe the BOJ will refrain from additional rate hikes this year. Nonetheless, nearly 90% predict that there will be increases by the end of March 2024, reflecting ongoing optimism for Japan's economic resilience.

As the political landscape continues to evolve in the U.S. and pressures mount on the global economy, all eyes will be on the BOJ's next moves—and whether they can navigate through turbulent waters without sparking further unrest in both domestic and international markets. The central bank's cautious but potentially transformative approach will be crucial in shaping Japan’s economic future.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)