Bitcoin Nears All-Time Highs Amid Record Low OTC Desk Inflows: What This Means for Investors

2024-10-30

Author: John Tan

Bitcoin Nears All-Time Highs

The world's leading cryptocurrency, Bitcoin (BTC), is edging closer to its all-time high, currently trading around $72,300, a mere 2% shy of the previous peak of $73,798 reached in March. This month alone, Bitcoin has surged approximately 14%, marking its most significant monthly increase since March—an impressive feat given the market conditions.

Shifting Dynamics in Bitcoin Trading

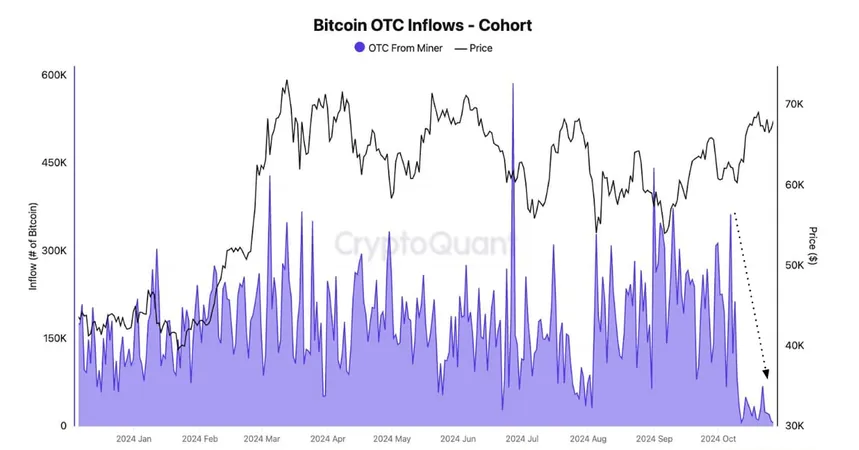

The dynamics of Bitcoin trading are shifting, particularly in the over-the-counter (OTC) market. Recent data from CryptoQuant reveals that OTC desks now hold 416,000 BTC, equating to around $30 billion—an increase from an average of less than 200,000 BTC earlier this year. This change indicates a growing preference among institutional investors and high-net-worth individuals to execute trades discreetly, without impacting the public markets.

Why the Migration to OTC Desks?

Why the sudden migration to OTC desks? These trading platforms provide the anonymity that large-scale investors prefer, allowing them to conduct sizable transactions without causing fluctuations in Bitcoin's market price. Over the last seven months, this trend has contributed significantly to Bitcoin's sideways trading pattern.

Impact on U.S. ETFs

Interestingly, the current stockpile of Bitcoin held on OTC desks might enable U.S. spot-listed exchange-traded funds (ETFs) to make substantial purchases without affecting Bitcoin's spot market price. Just this Tuesday, these ETFs recorded their highest daily purchases, yet that only accounted for 2% of the total BTC available on OTC desks—a less impactful ratio compared to the 9-12% seen earlier this year when the market boomed post-ETFs' regulatory approval.

Cautious Sentiments Among Investors

Despite seeing a stable OTC desk balance since early September, with only a marginal decrease of 3,000 BTC, the latest numbers raise eyebrows. The drastic reduction in daily inflows—down by 52% compared to earlier this year—signals potential cautious sentiment among investors. October's average inflow has plummeted to about 90,000 Bitcoin daily, the lowest observed in 2023.

Conclusion: Future Trajectory of Bitcoin

Market watchers and analysts are closely monitoring these movements, as they could play a crucial role in determining Bitcoin's trajectory. For Bitcoin to break its prior record in the current cycle, an uptick in daily inflows into OTC desks might be vital. The current decline in these inflows raises questions about future price movements.

As we approach a pivotal moment for Bitcoin in the coming months, traders and investors are advised to stay alert. Will Bitcoin shatter its historical ceiling, or are we witnessing a cooling-off period ahead? Only time will tell, but this shake-up in OTC trading patterns could provide the clues we need to navigate the volatile crypto landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)