Bitcoin Dips into Overbought Territory: Why Investors Should Be Wary of Further Losses

2025-03-31

Author: Daniel

What’s Happening in the Market?

The landscape for long-term investors is tricky, as no clear bullish reversal trend is on the horizon. Economic uncertainty, exacerbated by discussions surrounding U.S. President Donald Trump’s dubbed "Liberation Day" event, has left the market feeling jittery. Major U.S. tech stocks, including Tesla (TSLA) and Nvidia (NVDA), have recorded notable losses of 5% and 3%, respectively.

The Kobeissi Letter has highlighted that economic policy uncertainty is at its highest since 2020, with April 2nd being a date that investors should mark on their calendars. Meanwhile, the much-anticipated U.S. jobs report set to release on April 4th could significantly sway market sentiment and add to existing anxieties over impending tariff developments.

Gold’s Resurgence and Its Effect on Bitcoin

Interestingly, investors have flocked to gold ETFs, resulting in significant capital inflows. This shift could be a direct reaction to rising economic uncertainties, casting Bitcoin and the broader crypto market in a less favorable light, as they are considered riskier assets. Bitcoin’s reliability is now being contrasted against gold's historical stability.

Analyzing Bitcoin's On-Chain Metrics

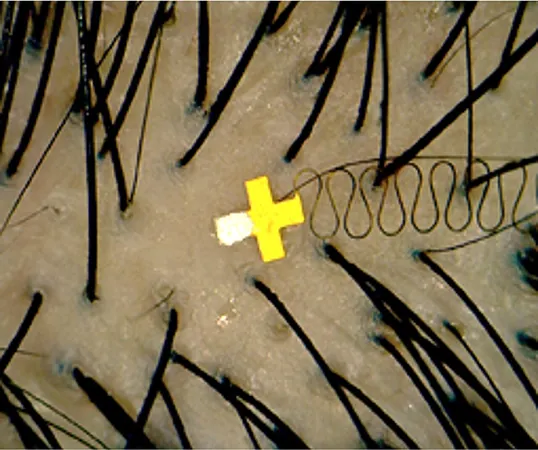

Recent analysis from AMBCrypto examined on-chain metrics to determine if Bitcoin could stabilize around the March lows of $78,000 or if further losses are on the horizon. The short-term holder MVRV Bollinger Bands chart indicated oversold conditions in late February and early March. By the current calculations, Bitcoin’s price is sitting below the average cost basis for short-term holders, which takes into account the "realized price" of coins that have moved in the past 155 days.

Bitcoin appears to have peaked in November and December, but it has since cooled significantly. Market sentiment suggests further depreciation may be imminent, with the oversold level currently marked at $78,950.

The Mayer Multiple: A Key Indicator

Another critical element in this analysis is the Mayer multiple, a metric that assesses Bitcoin’s fair value. Calculated by dividing Bitcoin’s market price by its 200-day Moving Average, the Mayer multiple is currently at 0.96. With Bitcoin lingering below the 200-day MA, which sits at $85,920, investors are advised to stay alert.

Historically, the last time Bitcoin dipped below its 200-day Moving Average was in August 2024, where it languished below this line for nearly two months. If history is any guide, we could be headed for a similar scenario.

What Should Investors Do?

For savvy investors eyeing buying opportunities, keeping an eye on the 0.8 Mayer multiple—approximately at the $68,740 mark—could present a "cheap" buying threshold. Long-term holders should prepare to weather the upcoming economic storm, as market sentiment is pivotal for any potential trend reversal.

In the meantime, employing a strategy like Dollar Cost Averaging (DCA) can help mitigate risks. Investors may also want to watch for significant price drops triggered by large liquidation events to capitalize on acquiring more Bitcoin at discounted rates.

Brace yourselves; the Bitcoin rollercoaster is far from over! Will you seize the opportunity or sit on the sidelines?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)