Bitcoin Dips Below $59,000: What to Expect Ahead of Possible Fed Rate Cut?

2024-09-16

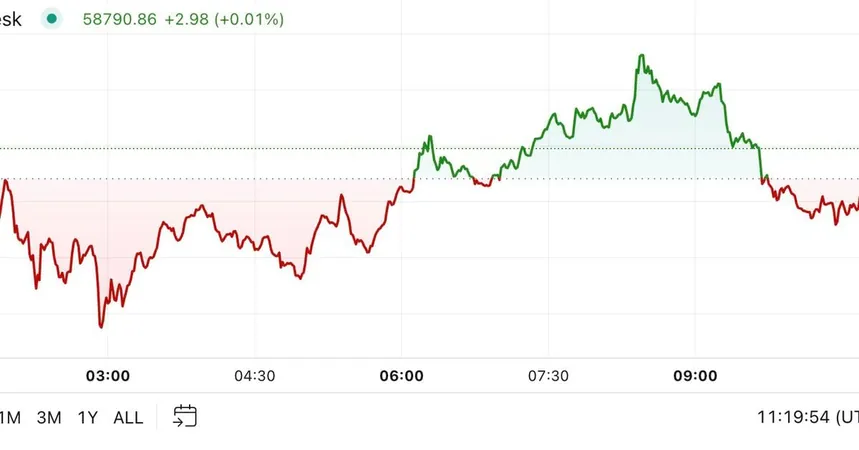

Bitcoin has seen a significant pullback, dropping under $59,000 after spending a considerable amount of time above the $60,000 threshold over the weekend. As of the European morning, BTC was trading at approximately $58,550, marking a 2.4% decline over the past 24 hours. This downturn occurs at the beginning of a pivotal week where traders around the globe anticipate the Federal Reserve's first interest-rate cut in more than four years.

The overall cryptocurrency market, measured by the CoinDesk 20 Index (CD20), reflected similar bearish sentiment, down by 3.6%. Earlier in the week, the market was buoyed by positive U.S. economic data, which incited a brief rally. Notably, Bitcoin exchange-traded funds (ETFs) experienced significant inflows, amounting to over $263 million; this is the highest amount seen since July 22. In contrast, ether ETFs only recorded marginal inflows of around $1.5 million.

Ether led the decline among major cryptocurrencies, falling 4.5% in the last 24 hours. Other notable losers included Cardano’s ADA, which saw a 5% drop, and Solana’s SOL, which declined by 4%. On the upside, BNB Chain’s BNB fared relatively better, sliding only 1.1%. Meanwhile, futures traders betting on price increases faced substantial losses, with over $143 million wiped out in the recent price drop, according to data from CoinGlass.

On another front, the BTC/ETH ratio, a measure of the relative performance of Bitcoin against Ethereum, has reached four-year lows. This decline indicates a challenging environment for Ethereum as it faces increasing competition from rising protocols like Solana, which has become a popular hub for launching memecoins, as well as other new chains like Coinbase’s Base and Telegram-affiliated TON, which are luring demand away from Ethereum’s native token.

Looking ahead, the Federal Reserve's upcoming interest-rate decision on September 18 has market participants on edge. While a reduction in rates is broadly anticipated, opinions regarding the extent of this cut are divided. Current Fed funds futures suggest a 41% chance of a modest 25 basis points (bps) reduction down to the 5%-5.25% range, juxtaposed with a 59% probability of a more drastic 50 bps decrease to the 4.7%-5% range. This uncertainty surrounding the rate cut's magnitude could lead to increased volatility in the financial markets, particularly for cryptocurrencies like Bitcoin.

As traders strategize their next moves, eyes remain firmly fixed on the Fed's decision, with potential ramifications for Bitcoin's recovery trajectory and the overall crypto landscape. Stay tuned—this financial rollercoaster may be far from over!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)