Beware: $172,000 Vanished in Phishing Scams Targeting POSB Customers!

2025-05-07

Author: Yu

A Rapid Rise in Phishing Scams

In Singapore, a shocking $172,000 has been snatched away from unsuspecting POSB customers since April due to crafty phishing scams. The police have reported at least 13 cases where victims fell for these deceitful tactics.

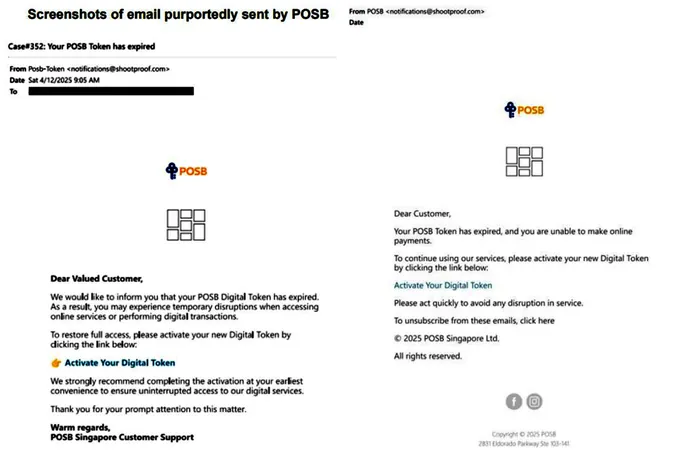

How the Scams Work

These scams typically start with a seemingly legitimate email, masquerading as a notification from POSB. Victims receive a message indicating that their mobile banking digital token is about to expire, urging them to activate or update it through a link provided. Clicking this link leads to a fraudulent website, where victims are tricked into divulging their banking credentials, card details, and one-time passwords.

The Moment of Realization

Sadly, many victims only realize they've been duped when they notice unauthorized transactions—often in foreign currencies—suddenly appearing in their bank accounts or on their cards.

Police Warnings and Precautions

On May 6, authorities issued a critical warning to the public: ignore any unsolicited emails, SMS, or messages claiming to be from banks, especially those containing clickable links. The police advise setting transaction limits for online banking and using features like Money Lock to safeguard savings against unauthorized withdrawals.

The Bigger Picture: Record Scam Losses in Singapore

The urgency of this issue is highlighted by the staggering $1.1 billion lost to scams across Singapore in 2024—a record-breaking figure that underscores the rampant nature of such fraudulent activities. It’s crucial for everyone to remain vigilant.

Get Help and Stay Informed

If you suspect you’re a victim of a scam or want to learn more about protecting yourself, please contact the anti-scam helpline at 1799 or visit scamshield.gov.sg. Stay alert and keep your finances safe!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)