Bank Predictions Take a Hit as Tariff Fears Loom: DBS Downgraded to 'Sell,' OCBC and UOB Hold Steady

2025-04-08

Author: Wei

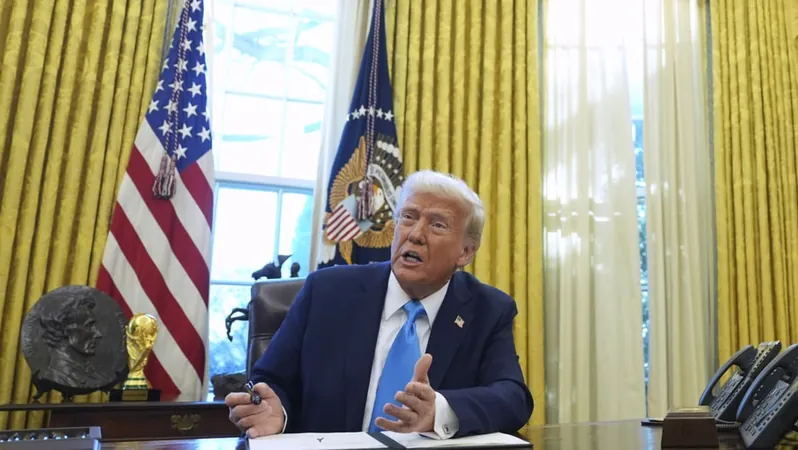

In a surprising turn of events, analysts have lowered their outlook on Singapore's major banks amid growing concerns about weakening loan growth and increasing credit costs, as trade tensions, spurred by tariffs imposed by former U.S. President Donald Trump, threaten to ignite a global trade conflict.

UOB Kay Hian (UOBKH) has taken a significant step, downgrading DBS Group Holdings from a 'buy' to a 'sell' rating, slashing its target price from S$49.80 to S$40. At the same time, the brokerage has maintained a 'hold' rating for OCBC, though it has reduced its target price from S$21.10 to S$16.85. Similarly, DBS Group Research has downgraded UOB from 'buy' to 'hold' and lowered its target price from S$38.50 to S$32.70. OCBC's target price has seen a decrease from S$17.60 to S$14.40.

As of Tuesday afternoon, DBS shares were trading at S$38.34, while OCBC and UOB were at S$15.01 and S$32.35, respectively.

In a recent note, UOBKH analyst Jonathan Koh expressed alarm over how banks' operations in the region would be adversely affected by Trump's imposing tariffs, with steep rates impacting several Asian economies: Vietnam (46%), Thailand (36%), China (34%), and Indonesia (32%). Although Singapore's baseline tariff rate is relatively low at 10%, it is projected that DBS, OCBC, and UOB will encounter average reciprocal tariffs of 15.9%, 17.3%, and 17.3% respectively, putting additional pressure on their financials.

This deteriorating environment has led UOBKH to revise its 2026 net profit forecasts for both DBS and OCBC downward by 13%, attributed to lower loan growth and surging credit costs stemming from non-performing loans in the manufacturing sector within the ASEAN region. Koh noted that the ripple effects of reduced intra-regional trade will echo throughout supply chains, with many companies' "China+1" strategies facing severe obstacles.

Furthermore, the analyst anticipates that manufacturers will be compelled to implement cost-cutting measures to remain viable, resulting in potential job losses and dampening domestic consumption. UOBKH has cut its loan growth forecasts for DBS from 4.8% to a mere 2%, while OCBC is lowered from 4.9% to 2%. The sustainability of dividend payouts by these banks is also under scrutiny, with projected dividends for DBS decreased to S$0.60 and OCBC likely to maintain S$1, provided the economic backdrop does not worsen further.

In a separate analysis, DBS Research Group's Derek Tan and Lim Rui Wen warned of "rough seas ahead" for Singapore banks, stating that their previous optimistic expectations, driven by proactive capital management and robust loan growth, have been undermined by the looming threat of a trade war. Current banking stock valuations are nearing historic highs, registering between 1.2 to 1.8 times forward price-to-book ratios based on FY2025 forecasts. This situation bears resemblance to the heightened volatility seen during the US-China trade war in 2018, when local bank stock prices nosedived by up to 35%.

With analysts foreshadowing a potential downturn for banking stocks, further economic shocks are anticipated. As tariffs escalate globally—China has signaled a willingness to retaliate against U.S. tariffs—uncertainty clouds the future. UOB economists have reduced their forecasts for U.S. gross domestic product growth from 1.8% to 1% by 2025, while the likelihood of a recession in the U.S. has surged to 40% from the previous estimate of 20-25%.

Prime Minister of Singapore Lawrence Wong has openly acknowledged the serious implications of the tariff situation, stating that the country's economic growth could be "significantly impacted" and a recession cannot be dismissed. Moreover, the Federal Reserve has maintained a cautious stance on interest rates, holding its projections steady while signaling potential cuts in the future, yet cautioning against further escalations in the trade war.

As interest rates in Singapore have started to trend downward, the outlook remains precarious. The three-month compounded Singapore Overnight Rate Average (SORA) has declined from 3.07% in 2024 to 2.56% in the first quarter of 2025. UOBKH has also downgraded the broader Singapore banking sector to 'underweight' status, projecting that Trump's "unprecedented" tariffs and a slowing global trade environment will negatively impact Singapore's wider economy.

Despite the challenges lying ahead, analysts from DBS caution that Singapore banks are equipped with substantial management overlays, which could range from S$600 million to S$2 billion, potentially providing a buffer against rising credit costs in case of loan defaults.

As the situation evolves, banks and investors alike must brace for what lies ahead in these turbulent economic times. Keep your eyes on the unfolding scenario, as the effects of this trade crisis could change the landscape of banking in Singapore and beyond.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)