Asian Markets Dip as Trump's Victory Raises Questions and Fed Decision Looms

2024-11-07

Author: Jia

Overview

Asian stock markets took a downturn on Thursday, November 7, following a historic rally in US stocks triggered by Donald Trump's unexpected return to the presidency. Investors are now grappling with the implications of this political shift for both the U.S. economy and global markets as they brace for the Federal Reserve's upcoming decision on interest rates.

Market Performance

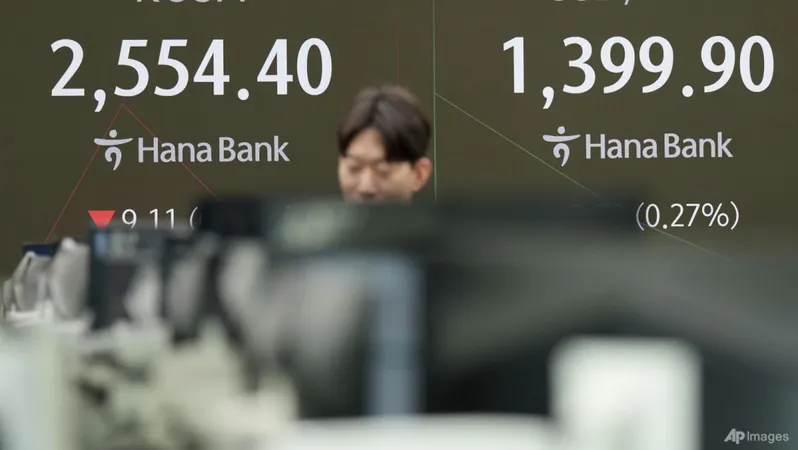

Japan's Nikkei 225 lost momentum after an initial gain, falling 0.6% to 39,246.86. The South Korean Kospi also saw a decline, slipping 0.4% to 2,554.57. Meanwhile, Australia’s S&P/ASX 200 edged down slightly by 0.1% to 8,191.00.

In Hong Kong, the Hang Seng Index dropped 0.7% to 20,386.36, and the Shanghai Composite index mirrored this decline with a fall of 0.7% to 3,359.99. Investors in Asia appear cautious as they weigh potential consequences of Trump's policies.

Trump's Tariff Plans

Trump has signaled plans to impose blanket 60% tariffs on all Chinese imports, a move that could escalate already tense trade relations, especially if China decides to take aggressive action towards Taiwan. Such tariffs could stifle Beijing's efforts to counteract slowing economic growth, presenting yet another challenge for the world's second-largest economy.

Economic Outlook

The prospect of trade wars is further complicated by the renewed focus on Trump's favored policies—including large tax cuts and deregulation—which investors are betting will boost economic growth in the U.S. This positive sentiment is not without risks; sectors such as renewable energy could face setbacks, and inflation fears may surface as rising tariffs impose additional costs on American households.

Wall Street's Response

On Wall Street, following Trump's victory, indexes surged to new heights, with the S&P 500 rising 2.5% to 5,929.04, marking its best performance in nearly two years. The Dow Jones Industrial Average jumped 3.6% to 43,729.93, while the Nasdaq composite soared 3% to 18,983.47. These gains reflected investor optimism, although the sustainability of this rally remains to be seen based on the control of Congress by the Republican Party.

Market Indicators

One significant indicator of market sentiment is the yield on the 10-year Treasury bond, which climbed to 4.43% from 4.29%. This sharp increase illustrates concerns about the potential for increased government borrowing due to tax cuts, which could exacerbate the existing deficit and foster higher interest rates.

Analyst Predictions

Goldman Sachs and other financial analysts suggest that Trump's policies, especially his approach to tariffs, may push inflation higher and place pressure on household expenses. Furthermore, a reduction in immigration could lead to labor shortages, compelling companies to offer higher wages, which in turn could exacerbate inflation.

Federal Reserve Expectations

As markets await the Federal Reserve's decision regarding interest rates, expectations remain for a possible cut. However, forecasts for subsequent cuts are being moderated as traders recalibrate their predictions.

Currency and Commodity Markets

In currency markets, the US dollar remained stable against the Japanese yen at 154.63, while the euro slipped marginally to $1.0728. In commodity trading, US benchmark crude oil slightly rose to $71.71 per barrel, and Brent crude climbed to $75.16.

Bitcoin Market

Additionally, the price of Bitcoin experienced a minor setback, dropping to $76,165 following its unprecedented rise above $76,480. Trump's assertion to position the U.S. as the "crypto capital of the planet" continues to draw significant attention within cryptocurrency circles as market participants adjust to the new geopolitical landscape.

Conclusion

As political and economic realities continue to evolve, investors will undoubtedly need to monitor developments closely to navigate this turbulent period effectively.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)