Are Singaporeans Ready for Retirement? A Deep Dive into Their Concerns and Aspirations

2025-03-22

Author: Li

Introduction

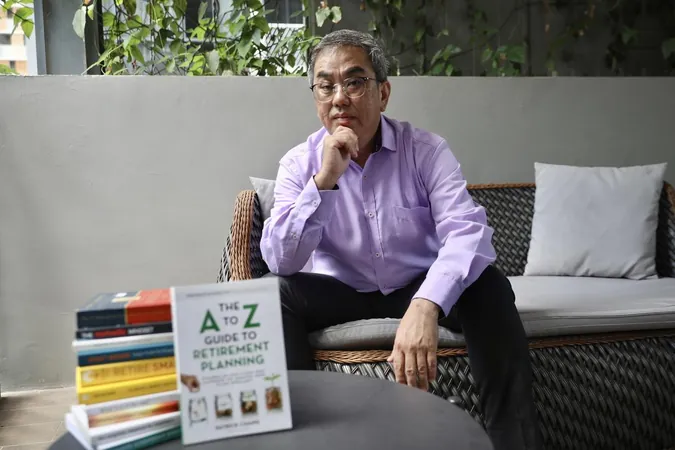

SINGAPORE – As discussions around retirement grow increasingly prominent, many Singaporeans find themselves apprehensive about what lies ahead. Financial adviser Patrick Chang, aged 58, is leading the charge in redefining retirement with his innovative concepts and insights. Having authored the self-published book "The A to Z Guide to Retirement Planning" in 2016, he is currently preparing his sequel, "Retire Retirement, Welcome Protirement: The Essentials A to Z."

The Concept of Protirement

The concept of "protirement," a term originating in the early 1960s, presents a shift from traditional retirement focused solely on leisure. Instead, it encourages individuals to seek fulfilling pursuits post retirement. Chang advocates for continuing to work while incorporating passion projects, consultancy roles, or part-time engagements that utilize one's experience and skills. He envisions a future where older individuals not only retire to rest but also contribute by mentoring the younger generation.

Patrick Chang's Journey

Reflecting on his own preparations for protirement, Chang has spent a decade investing for both his and his wife’s retirement. He aspires to transition into a coaching business, integrating his growing qualifications in life and career coaching into a fulfilling new chapter beyond conventional work life.

Survey Insights

According to a survey conducted by The Straits Times, 25 Singaporeans between the ages of 35 and 75 shared their sentiments about retirement, illustrating a spectrum of reactions ranging from worry and indifference to optimism. Many expressed the desire to maintain autonomy and good health, recognizing that poor health and escalating medical expenses could threaten their retirement plans.

Personal Stories and Concerns

One highlight was the story of a 52-year-old man, Luqman (a pseudonym), who voiced his fear of losing financial independence upon retirement. Like many others, he expressed concerns about rising living costs and the importance of not becoming a burden on his children. His plan involves staying active by starting a small F&B business with his wife.

Meanwhile, Singapore's retirement age, set to rise from 63 to 64 by July 1, 2026, poses unique challenges. As the city-state heads towards becoming a "super-aged" society—where one in four residents will be 65 or older by 2030—issues surrounding financial readiness and mental health become paramount.

Desire for Productivity

Mr. Fong Kok Wah, a 75-year-old supervisor, exemplifies the desire to remain productive even past retirement age. He reflects on his industry experience and how he intends to pivot toward healthcare roles, emphasizing the importance of staying engaged and vigilant against the burden of health-related expenses.

Mixed Reactions

Contrastingly, other interviewees exhibited a mix of contentment and anxiety. A 68-year-old food retailer shared how the pandemic interrupted his bustling career, highlighting the "vacuum" it created in his life and the essential role work plays in maintaining mental health.

Anxieties surrounding inflation were prevalent among younger professionals too, with many proactively planning their financial futures amid rising costs. Ms. Yang Xiao, 40, expressed new-found concerns after experiencing significant rent hikes, which ignited worries about her family’s overall retirement well-being.

Psychological Perspectives

Psychologist Andy Ho observed that the disparity between perceptions of retirement adequacy varies significantly. Higher earners often navigate the complexities of expense management, while lower-income individuals prioritize immediate survival over long-term savings.

Redefining Values

Amid these varying perspectives, many participants acknowledged the psychological impact of their careers on their identities and mental health. As retirement approaches, the question of "what next?" often looms large, compelling individuals to redefine their values, purposes, and plans for this new life stage.

Call for a Positive Shift

As experts and advisers stress the importance of active retirement planning, they call for a societal shift towards optimism about retirement—promoting the idea that this phase can be an opportunity for growth, not an end. The narrative around retirement is evolving, and with proactive measures, many Singaporeans hope to transition from a sense of dread to a spirit of anticipation.

Conclusion

Ultimately, addressing these concerns requires a collective effort, not just from the individuals planning for retirement, but also from institutions, family, and the government, to create a supportive environment for a prosperous and fulfilling retirement experience.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)