AppleTV+ Faces Financial Struggles as Creator Economy Shifts Focus to Retail

2025-03-24

Author: Wei Ling

AppleTV+ in Trouble

Apple is reportedly struggling with its ad-free streaming service, AppleTV+, facing losses of approximately $1 billion annually, as highlighted by The Information. Despite gaining 45 million subscribers last year, the platform's subscription revenue is not enough to cover its escalating content and marketing expenses.

Since its launch in 2019, Apple has invested about $5 billion annually on original content, although CEO Tim Cook recently reduced this budget by $500 million—a decision that raises questions about the service’s long-term strategy. For comparison, Netflix boasts around 302 million subscribers and is set to allocate a staggering $18 billion toward content this year alone.

While Apple’s valuation stands at about $4 trillion, enabling it to absorb such losses, the company anticipated AppleTV+ would incur between $15 billion and $20 billion in losses during its first decade. This places AppleTV+ in a precarious position within an increasingly competitive streaming landscape.

Disney+, another major competitor, reported losses of $11.4 billion from 2020 to 2024 but achieved profitability for the first time last year, thanks largely to the introduction of an ad-supported tier and increased subscription prices—approaches that many streaming platforms, including Netflix, have adopted.

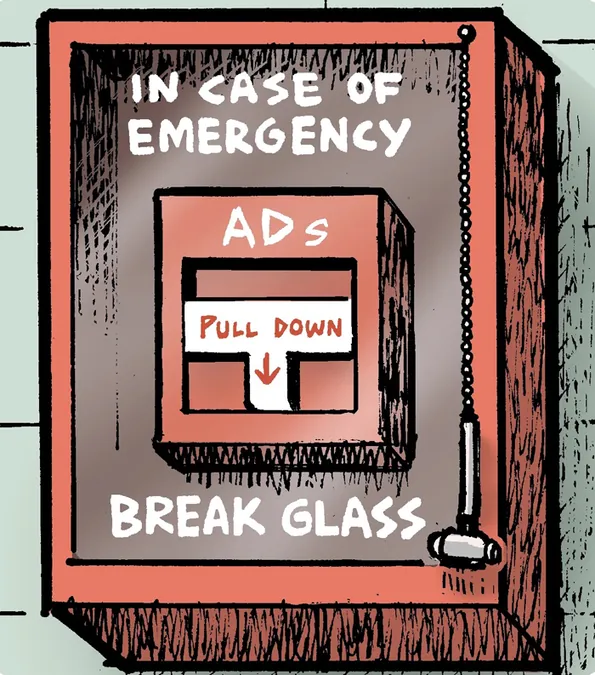

As of now, AppleTV+ has resisted introducing third-party advertisements or raising subscription prices since 2023. How long this will continue remains uncertain as the pressure mounts.

The Declining Creator Economy

A notable shift is occurring within the creator economy, particularly in the direct-to-consumer (DTC) brand space. Experts, including Scott Fisher from Select Management Group, suggest that the era of influencers successfully launching independent DTC brands may have come to an end. Consumers have expressed fatigue from an overabundance of influencer promotions, exacerbated by an influx of investment in creator marketing.

The creator boom lasted from 2021 to 2023, coinciding with lower social media advertising costs and robust mobile attribution. However, changes such as Apple’s App Tracking Transparency have fundamentally altered the digital marketing landscape. Now, creators must have their brands sold through major brick-and-mortar retailers to make economic sense.

A case in point is Sacheu Beauty, a brand managed by influencer Sarah Cheung, which recently secured $15 million in Series A funding, made possible by its availability in 5,000 retail stores. This trend could compel large companies, like Unilever, to focus on acquiring established brands with retail partnerships rather than collaborating with new creator brands.

Accenture Faces Challenges Amid Budget Cuts

In a related note, the consulting firm Accenture is experiencing fallout from recent cuts in government spending as it relates to advertising agencies. CEO Julie Sweet indicated that Accenture Federal Services represents a significant portion of the company’s revenue, which is now under strain due to a slowdown in government contracts.

While Sweet conveyed confidence in the company’s fundamentals, she noted rising concerns within the organization, leading to layoffs among employees linked to federal projects or those without current assignments. The potential repercussions for Accenture’s marketing division, Accenture Song, could be significant as they grapple with the loss of funding and reduced federal engagement.

Stay Tuned for More Developments

In other news, Yahoo has sold TechCrunch to the media investment firm Regent, and NBC Sports is contemplating a bid for MLB rights for the 2026-2028 seasons. Furthermore, Meta is exploring AI-generated comment suggestions for Instagram—a possible next step in its ongoing innovation efforts.

As these developments unfold, the landscape of streaming services and the creator economy continues to evolve rapidly, signaling more changes ahead.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)