$100K Bitcoin Call Option Sparks Hope for Record Highs Post-Trump Inauguration

2025-01-06

Author: Wei

Anticipation of Bitcoin Surge Post-Inauguration

In the world of cryptocurrency, Bitcoin (BTC) traders are buzzing with anticipation as they predict that prices could soar to new all-time highs following the inauguration of President-elect Donald Trump on January 20. Recent trading activity signals a bullish sentiment, with a notable purchase of call options that suggests significant confidence in Bitcoin's upward trajectory.

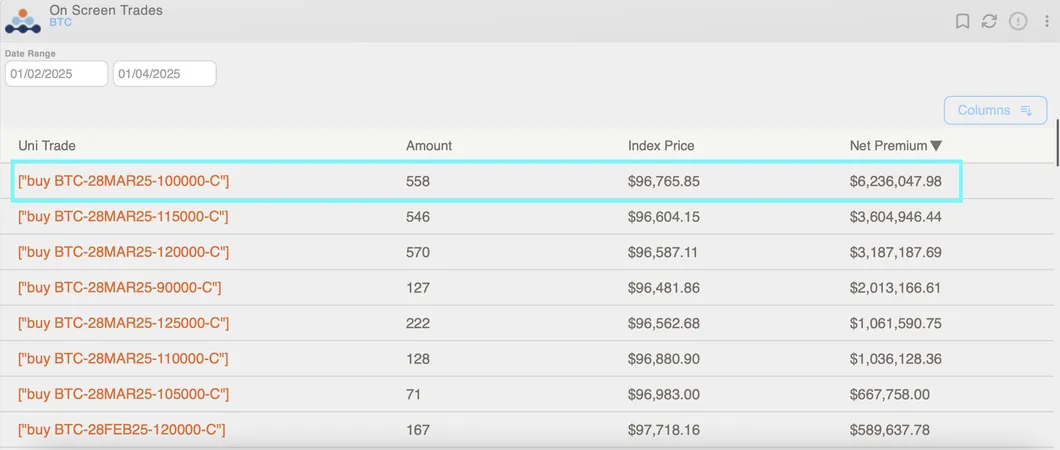

Significant Investment in Call Options

On Saturday, a single trader on the crypto exchange Deribit made waves by investing over $6 million to secure $100,000 strike call options set to expire on March 28, according to data from Amberdata. This indicates strong expectations that Bitcoin's price will surpass the $100,000 mark just months after the inauguration. Such a move could potentially lead to once-unimaginable price levels in the cryptocurrency market.

Growing Interest in Higher Strike Options

Adding to the excitement, traders are also showing strong interest in $120,000 strike call options, underlining the belief that a substantial rally may be on the horizon. This option has emerged as the most popular choice among traders, with a notional open interest of $1.52 billion, highlighting the market’s bullish outlook.

Understanding Call Options

A call option offers the buyer the right, but not the obligation, to purchase the underlying asset at a predetermined price within a set timeframe. This type of trading is a strong indicator of bullish sentiment, as it reflects hopes for significant gains from an anticipated upward price movement.

Current Bitcoin Performance

The renewed interest in Bitcoin comes as the leading cryptocurrency attempts to reclaim the coveted $100,000 threshold. Currently, BTC is trading just above $99,500, marking an approximate 8% recovery from a recent low of $91,384 recorded on December 30, according to CoinDesk and TradingView.

Inauguration's Potential Impact on Bitcoin

Greg Magadini, the director of derivatives at Amberdata, suggests that the period surrounding the inauguration could be a key moment for bullish policies that may serve as catalysts for Bitcoin's rise. As these announcements are expected, traders remain hopeful that they will lead to increased investment and interest in the cryptocurrency market.

Regulatory Optimism and Its Challenges

Furthermore, regulated cryptocurrency index provider CF Benchmarks has echoed this optimism but cautioned that any delays in policy development could dampen the bullish sentiment. They pointed out that a reorganized Securities and Exchange Commission (SEC) led by pro-crypto advocates could mitigate enforcement risks and stimulate innovation within the sector. Such proactive measures could encourage greater investor confidence, which is crucial for market stability.

The Market Outlook Post-Election

Overall, expectations of favorable regulatory changes have energized crypto market sentiment since Trump's electoral victory in early November. Bitcoin surged from approximately $70,000 to reach new heights above $108,000 shortly after the election. However, the momentum faced a setback in late December, likely due to year-end profit-taking and the Federal Reserve's cautious interest rate outlook.

The Uncertain Future of Bitcoin

As traders and investors keep a close watch on the developments following the inauguration, the cryptocurrency community is left wondering: Will Bitcoin breach new all-time highs, or will market conditions shift unexpectedly? Only time will tell.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)