Why Wall Street Is Cheering Weak Economic Data: Insights from Wharton Professor

2025-09-09

Author: Ting

Markets See Opportunity in Weak Jobs Data

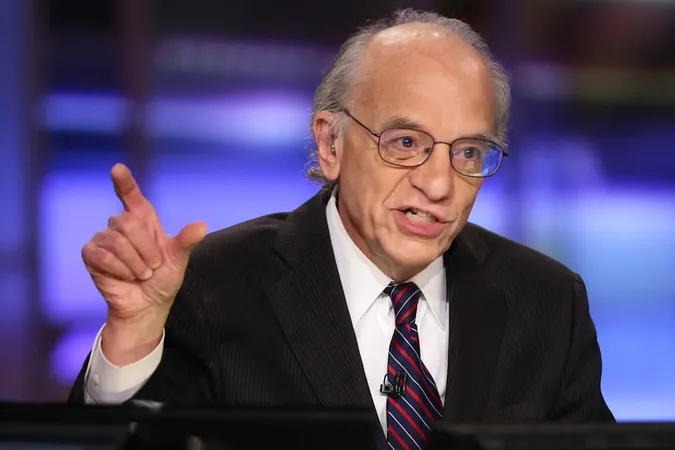

The latest labor statistics are sending shockwaves through Wall Street, invigorating hopes for Federal Reserve rate cuts. Wharton’s Jeremy Siegel forecasts a trio of cuts this year, as markets rally on this promising outlook. However, Goldman Sachs' Jan Hatzius cautions that job growth remains precarious, although he anticipates a rebound by 2026 as tariffs ease and economic policies shift.

A Complex Picture for the Fed

Recent job reports paint a less than rosy picture that the Federal Open Market Committee (FOMC) would have preferred. This week’s upcoming inflation data is expected to present a similar narrative. With conflicting pressures in play, Fed Chairman Jerome Powell's rate decisions are becoming more intricate, yet markets perceive this as a win—hinting that the Fed may finally lower interest rates.

Wall Street's Wish List

This sentiment resonates across Wall Street and Washington, where many believe the current rate of 4.25-4.5% is too constrictive. The goal? To encourage economic growth through reduced borrowing costs.

Siegel's Take on Rate Cuts

Siegel, a senior economist at WisdomTree, emphasized, "The market got exactly what it needed last week: proof that the economy is slowing—not collapsing—and that the Federal Reserve has the green light to start cutting rates." He expects a 0.25% cut at the FOMC's September meeting, with two more anticipated cuts in 2025.

An Optimistic Outlook

Even with potential upside surprises in inflation reports next week hovering around a 3% year-over-year pace, Siegel believes the path for rate cuts is set. He noted that the focus has shifted decisively towards labor-market weakness rather than temporary price hikes.

Global Market Reactions

This morning, markets are looking slightly up, with S&P 500 futures showing a 0.11% increase. European markets have remained relatively flat, while Asia saw mixed results, with Hong Kong’s HSI bouncing back by 1.19%, though Japan's Nikkei 225 dipped by 0.42%.

Long-Term Vision

Siegel advocates for the Fed to lower rates below 3% over time, arguing that the economy doesn’t require restrictive real rates given subdued money growth and low inflation trends. This shift could lead to a normalization of the yield curve and positively influence equity multiples, particularly for interest-sensitive sectors.

Analyzing the Data

The bond market seems to concur, with U.S. 10-year Treasury yields dipping back toward 4%. The CME Group’s FedWatch barometer implies an 88% probability of a rate cut, with some analysts even predicting a 50bps cut.

Cautious Optimism Ahead

But Goldman Sachs' Jan Hatzius warns that further adjustments may be necessary. Despite the optimism, job growth lags behind the breakeven rate needed to stabilize the unemployment rate. However, he sees potential for gradual growth in the economy as financial conditions remain favorable and higher tariffs ease.

Global Market Snapshot

As of this morning, here’s a brief look at the global markets: S&P 500 rose by 0.21% yesterday; S&P futures are up 0.11%. The European markets show slight declines, with the FTSE 100 up by 0.13%. In Asia, while India’s Nifty 50 saw a 0.37% increase, Japan's and China’s markets faced minor losses.

What's Next?

With Bitcoin soaring to $112K, the financial landscape remains dynamic. All eyes will be on the upcoming economic indicators, as analysts and investors alike scramble to interpret how weaker data could lead to a better financial environment for all.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)