Why Are Bond Yields Soaring Following Trump’s Election Victory?

2024-11-07

Author: Wei

Introduction

In the world of finance, there's a popular saying that encapsulates the contrasting attitudes of stock and bond investors: stock investors tend to be optimists, while bond investors are more like pessimists. As the news of Donald J. Trump’s victory rolled in, stock prices surged, reflecting a wave of bullish sentiment driven by his proposed policies of tax reductions, deregulation, and increased government expenditure. Investors seemed relieved that the election concluded decisively and were quick to embrace the potential upward momentum these policies could bring to the market.

Bond Market Reaction

However, the outlook wasn't so sunny for bond investors. With government spending likely to increase under Trump, many in the bond market expressed concerns about potential inflation. This skepticism has resulted in a notable rise in government bond yields. Essentially, this means that investors are seeking higher interest rates as compensation for the perceived risks associated with lending money to the government.

Rising Yields

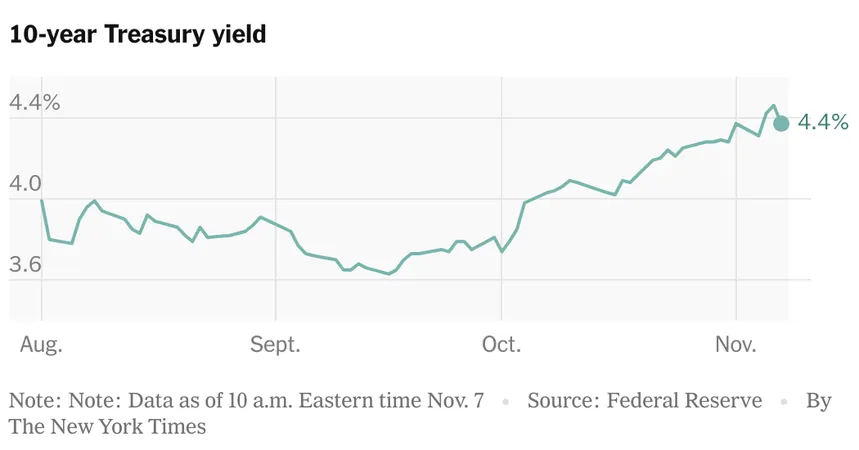

In the wake of Trump's election, the yield on 10-year Treasury notes saw an impressive jump of 0.2 percentage points, climbing to 4.35% from around 3.8% at the start of October. This increase signals a shift in investor sentiment as they brace for the economic implications of the new administration’s policies.

Federal Reserve and Interest Rates

But one might wonder: What about the Federal Reserve cutting interest rates? Does that affect these yields? The answer is complex. The Federal Reserve primarily influences short-term interest rates through its policy decisions, particularly the federal funds rate. However, for long-term investments such as bonds, investors are more focused on potential economic trajectories, including growth rates and inflation, rather than just the Fed’s immediate actions.

Fed's Rate Cut

On Thursday, after the election, the Fed cut rates by another quarter of a percentage point—their second reduction in two months. This move was aimed at supporting the economy amid signs of slowing inflation. Yet, for bond investors, the pressing question revolves around how Trump’s economic policies will shape future growth and inflation rates, which could ultimately prompt the Fed to change its course.

Inflation Concerns

As stock investors revel in the prospect of corporate profit growth fueled by a loosening regulatory environment and favorable tax conditions, bond investors are less optimistic about the sustainability of this trend. Recent trends indicate that inflation expectations are on the rise. This is concerning because it suggests that higher inflation could lead to steeper interest rates, impacting everything from consumer loans to mortgages. In fact, Freddie Mac reported that the average rate on a 30-year mortgage has climbed to 6.79%, the highest point since July, illustrating how closely linked bond yields are to consumer financing costs.

Government Debt

Adding to the dialogue is the U.S. government's considerable debt load, estimated at approximately $35 trillion. The costs associated with servicing this debt have soared to over $1 trillion—accounting for 17% of federal spending. As Trump’s administration looks to enact aggressive spending policies alongside tax cuts, analysts warn that the government will likely need to borrow even more money.

Future Implications

There remains a pressing concern: what happens when investors start demanding even higher yields to continue lending to a government that is ramping up its borrowing? Although this situation isn't imminent, the prospect of investors increasingly requiring greater returns can lead to a cycle of rising costs for debt servicing, which would, in turn, strain federal finances further.

Conclusion

In short, while the stock market might bask in the glow of potential gains from a Trump presidency, the bond market is ringing alarm bells. Investors will be watching closely to see whether Trump's policies will indeed stimulate the economy or trigger inflation that drives yields even higher. As we navigate the post-election landscape, the divergence between the buoyant stock market and the anxious bond market may define the economic outlook in the months and years ahead. Stay tuned for how these developments will unfold!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)