Wall Street Predicts a 30% Surge for Nvidia Stock in the Next Year: Is Now the Right Moment to Invest?

2024-09-16

Wall Street Predicts a 30% Surge for Nvidia Stock in the Next Year: Is Now the Right Moment to Invest?

Investors are abuzz over Nvidia (NASDAQ: NVDA) as Wall Street analysts have set their sights on the stock with an average one-year price target of $153. This forecast includes a high estimate of $200 and a low of $90, placing Nvidia’s current price of around $120 in an intriguing position — suggesting a potential upside of roughly 30%. But with such promising projections, is it a good time to jump on the Nvidia bandwagon?

The AI Revolution and Nvidia's Strategic Edge

Nvidia has positioned itself at the forefront of the artificial intelligence (AI) boom, with its graphics processing units (GPUs) being essential for training AI models. The relentless demand for AI-related computing power underpins Nvidia's robust growth trajectory. Although the AI market continues to expand, a critical consideration arises: can Nvidia sustain its dominance amidst increasing competition?

Many analysts anticipate that major tech firms will reach a balance between their AI ambitions and the computing resources at hand. There are concerns that if AI demand eventually stabilizes, Nvidia’s GPUs may not be as heavily relied upon, leading to potential volatility in demand. Yet, feedback from Nvidia's significant clientele, particularly regarding capital expenditures, suggests that the appetite for Nvidia’s offerings will remain strong at least through 2025.

The Valuation Dilemma: Are High Expectations Priced In?

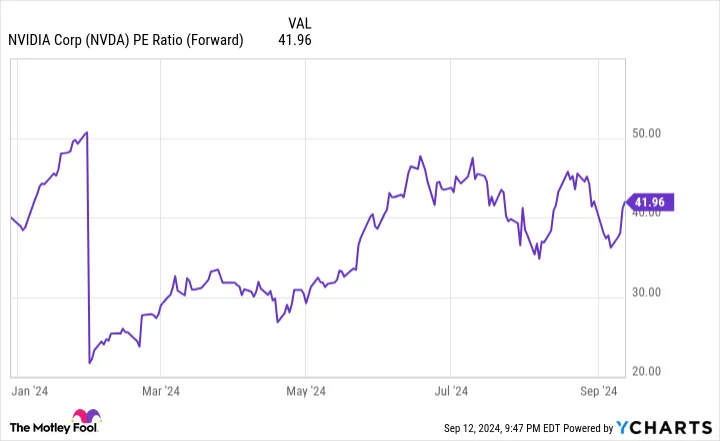

Currently trading at 42 times its forward earnings, Nvidia's stock commands a hefty valuation. Investing enthusiasts often argue that substantial growth in earnings justifies such valuations. Furthermore, Nvidia has seen its profit margins expand dramatically due to the soaring demand for its GPUs.

However, there's a caveat. In recent quarters, those margins have shown signs of contraction. While lower margins could merely reflect temporary fluctuations, investors must remain vigilant. A decrease in profits could translate to a drop in stock price, as Nvidia's current valuation heavily hinges on its profit margins sustaining their elevated levels.

Can Nvidia Deliver a 30% Return?

Could Nvidia indeed experience a 30% price increase over the next year? Many believe it could, particularly if the companies leveraging its technology continue to demand its cutting-edge products. The forecast appears optimistic, especially if one accounts for the potential rise of AI and the technological advancements yet to come.

A Word of Caution for Prospective Investors

Yet, potential investors should consider the opinions of financial experts. Some analysts point out that the Motley Fool Stock Advisor recently curated a list of their top 10 stock picks, notably excluding Nvidia. This raises an important question: what do they know that others don’t?

Historical performance is also key: had you invested in Nvidia at an earlier date, you would have seen returns soar. However, as with any stock, past performance is not indicative of future results.

In conclusion, if you’re contemplating an investment in Nvidia, be sure to weigh all factors, including current valuations, market trends, and expert opinions. With the potential for a 30% rise within the year, now may indeed be an advantageous moment to consider acquiring shares of this tech titan — just be cautious and informed before making your move!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)