Tyme Group Secures $250 Million from Nubank, Cements $1.5 Billion Valuation!

2024-12-17

Author: Ming

Tyme Group Secures Major Funding

In a remarkable leap forward for African fintech, Tyme Group has successfully raised a whopping $250 million in a Series D round, catapulting its valuation to an impressive $1.5 billion. This significant funding achievement was spearheaded by Nu Holdings, the parent company of Latin America's leading fintech, Nubank, which invested $150 million for a valuable 10% stake.

Joining the investment parade, the M&G Catalyst Fund contributed $50 million, while existing shareholders rallied together to provide the remaining $50 million.

Innovative Banking Model

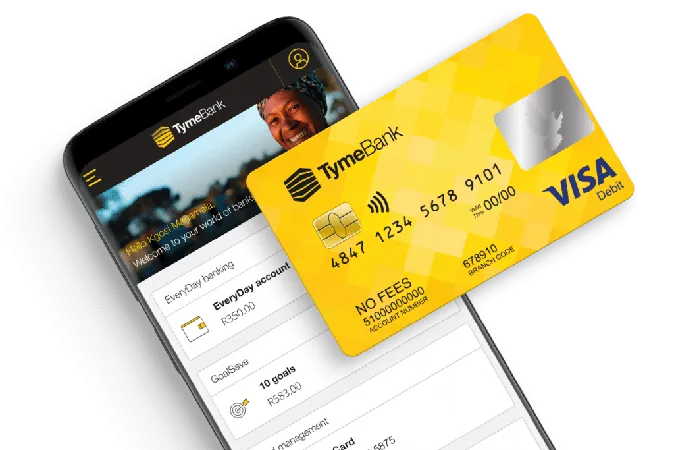

Founded in 2019, Tyme Group is revolutionizing financial services through its innovative hybrid digital banking model that bridges the gap between online banking and physical service locations. Headquartered in Singapore, Tyme is dedicated to developing and scaling digital banks across emerging markets. It offers a variety of services, including checking and savings accounts, debit cards, credit through modern buy now, pay later schemes, and cash advances. Today, the fintech proudly serves 15 million customers across South Africa and the Philippines.

Growth in South Africa and the Philippines

TymeBank, its South African division, has achieved a remarkable user base of 10 million, significantly contributing to its growth trajectory. In 2022, Tyme launched GoTyme in partnership with the Gokongwei Group, enabling the company to tap into the Philippine market and attract 5 million users.

Financial Highlights and Future Plans

With over $400 million in customer deposits and $600 million in financing extended to small businesses in both markets, Tyme is on a roll. Not resting on its laurels, the company has ambitious plans for further expansion into Vietnam and Indonesia in the coming year.

Nubank’s Strategic Expansion Beyond LatAm!

Coen Jonker, the chairman of Tyme, emphasized the importance of this funding round, as it elevates Tyme's total capital raised to nearly $600 million. This financial milestone reflects a rejuvenated interest in fintech from investors after a global slowdown, particularly in the face of rising interest rates. Notably, Tyme joins the ranks of Nigeria's Moniepoint as one of the few African fintech firms to achieve unicorn status this year.

Tyme is eyeing an exciting Initial Public Offering (IPO) in New York by 2028, coupled with plans for a secondary listing in South Africa. Depending on how these strategies unfold, the potential for significant capital growth for investors is immense.

Nubank's Vision for Collaboration

For Nubank, the investment in Tyme aligns with its strategy to diversify operations and harness the opportunities prevalent in emerging markets outside of Latin America. With Nubank firmly established in Brazil, Mexico, and Colombia—boasting over 100 million customers—the company faces increased competition from rivals like Neon and C6 Bank.

David Vélez, founder and CEO of Nubank, expressed confidence in the collaboration, stating, “Since the beginning of Nubank, we believed the future of financial services globally lies within digitally-native companies. After meeting numerous teams across different regions, we believe Tyme Group is exceptionally positioned to become a leader in digital banking in Africa and Southeast Asia. We look forward to sharing our extensive scaling knowledge to help Tyme reach hundreds of millions of customers.”

Conclusion

Stay tuned, as Tyme Group is set to change the financial landscape in the coming months and years!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)